What is tiered pricing and how does it work?

tastyfx products are always priced with the tightest spread available. In this pricing model, trade size and trade history determine the spread cost to enter a position through a transparent tier system.

Size

Each tier has a size threshold—in other words, the largest position size possible for you to trade and for us to fill—and an associated spread. The higher the size threshold, the wider (i.e., higher) the spread. Size thresholds vary by market and liquidity conditions.

Large trades

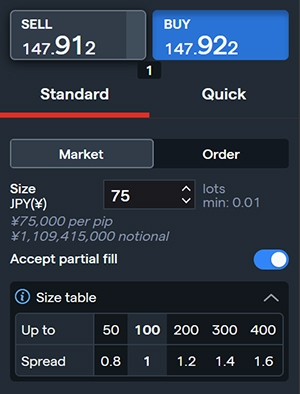

A pricing table will appear on the deal ticket for large trade sizes. This table will clearly show the size threshold in lots and spread payable for each tier.

Small and medium trades

Most trades will fall within the lowest price tier and, as such, be executed at our tightest spreads. Traders will notice that the size table will not appear on deal tickets with lot sizes entered that fall in the lowest price tier.

Recent trade history

Recent trades will be included when determining the size – and therefore the price tier – of your current trade if they were placed:

- In the same market

- In the same direction (i.e., long or short)

- Within the last 6 seconds

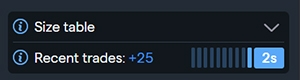

Where applicable, a timer will appear on the deal ticket. When the timer reaches zero, your recent trades will no longer factor into your current trade size.

Example

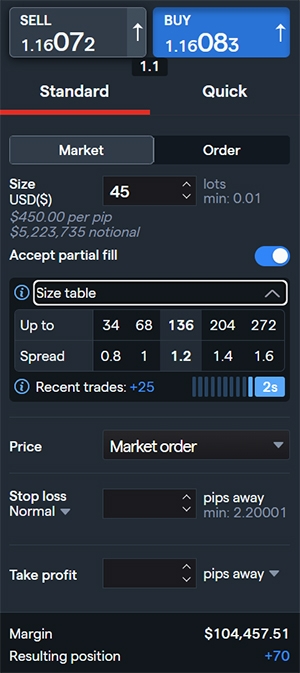

You place a trade for 25 lots of long EUR/USD.

Five seconds later, you place a second trade for 45 lots of long EUR/USD.

Since both trades are in the same market (EUR/USD), in the same direction (long), and placed within 6 seconds, they’ll all be taken into account when determining the size and price tier of your final trade.

So, your second trade will be priced based on a combined size of 70 lots (25 + 45). In this example, that would correspond to a spread of 1.2 pips for the tier of 68-136 lots.

Stop orders

Stop orders will be priced upon execution in the same way as standard trade, i.e., according to their tier (which is determined by their size and your recent trade history). This may result in price slippage.