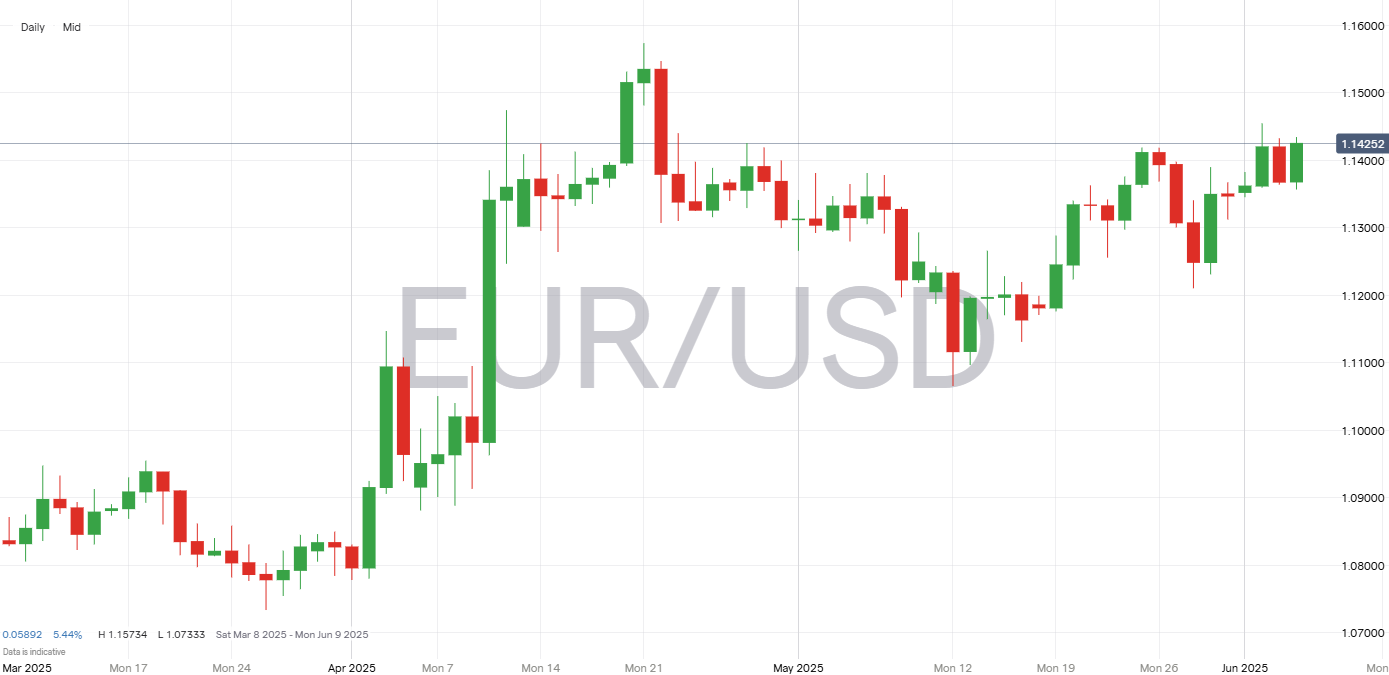

Will an ECB rate cut take down EUR/USD?

The ECB's cutting cycle continues, while EUR/USD hits new highs. Discover how much of an impact this week's central bank meeting could have on the pair and what other factors to watch.

.jpg?format=pjpg&auto=webp&quality=90&width=820&disable=upscale)

EU Inflation Steadies Below 2%

May data released on Tuesday revealed that Euro Area inflation has softened to 1.9%, slightly below the expected 2%. This development triggered a modest 50-point sell-off in the euro-dollar market that has since been erased on widespread dollar weakness. However, the broader implications of this inflation data will depend on how it interacts with the upcoming European Central Bank (ECB) rate decision and ongoing geopolitical factors.

ECB Set to Cut 25bps for the 8th Time

Tomorrow (8:15am EST), the ECB is poised to announce its latest monetary policy decision, with a widely anticipated 25-basis point cut. This move marks the eighth cut in the current cycle, reducing rates from 4% to 2%. Despite these aggressive cuts, the euro has shown resilience, trading near 1.14, a level not consistently maintained since the post-pandemic economic boom. While EUR/USD is likely to move on the meeting announcements, traders should stay apprised to ECB president Lagarde's comments shortly after for additional color on the bank's sentiment towards inflation, trade tensions and more.

Rate Differentials Not a Factor in 2025

As the ECB prepares for another rate cut, market expectations suggest only one more is anticipated from the European bank this year, aligning more closely with the US Federal Reserve's outlook of two rate cuts in 2025. If this dynamic plays out, that would leave the US overnight interest rate over 2% higher than the Euro Area's on a medium term outlook. Despite this, the rate differential between the euro and the dollar is not currently a significant market mover in FX markets as it continues to be overshadowed by broader geopolitical and trade tensions.

What Could This Mean for EUR/USD?

The upcoming ECB meeting could be a significant event, potentially expanding Thursday's trading range for the euro-dollar. However, in the long term, the future of the EUR/USD is more likely to be influenced by trade developments or a restored confidence in U.S. assets. Until these broader issues are resolved, expect the euro-dollar to remain volatile, with external factors overshadowing interest rate differentials. Traders will be keenly watching how the ECB's decision plays out alongside evolving trade talks and geopolitical tensions.

EUR/USD price history

How to trade EUR/USD

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.