Rising Volatility Makes USD/CAD a Pair to Watch in 2026

Discover what's behind the Canadian dollar's recent surge, its surprising movement compared to other USD pairs, and what drivers to monitor in the weeks ahead.

Key Points

- USD/CAD heads into 2026 with momentum once again tilting toward the Canadian dollar.

- The next major move in USD/CAD is likely to be catalyst-driven, with upcoming central bank decisions and a potential U.S. Supreme Court ruling on tariffs poised to influence near-term direction.

- USD/CAD is also attracting renewed trading interest, with rising volatility setting it apart from other major currency pairs.

USD/CAD exits 2025 in transition, following a year defined by pronounced shifts in direction. Like many major currencies, the Canadian dollar gained ground against the U.S. dollar during the first half of the year. That strength faded in late summer and early autumn, as the greenback mounted a modest recovery.

More recently, however, the momentum has swung back toward the Canadian dollar. As of mid-December, USD/CAD is hovering near 1.38, placing the pair within reach of its strongest levels in 2025. The latest move reflects a subtle but important policy divergence: while the Bank of Canada held rates steady in December, the Federal Reserve delivered a 25-basis-point cut, chipping away at the U.S. dollar’s rate-driven edge.

For context, USD/CAD has traded between approximately 1.36 and 1.47 over the past 12 months—a narrower band compared to its broader five-year range of 1.21 to 1.47. With volatility now picking up in USD/CAD, and several high-impact catalysts on the horizon, this currency pair stands out as one of the more dynamic—and potentially reactive—major currency pairs heading into 2026.

Bank of Canada Holds, Fed Cuts—Dollar Loses Its Edge

A review of recent USD/CAD activity helps clarify where the pair stands heading into year-end.

In December, the Bank of Canada held interest rates steady, while the Federal Reserve delivered a 25-basis-point cut. At face value, U.S. rates remain higher—the Fed’s target range now sits at 3.50% to 3.75%, compared to Canada’s overnight rate of just 2.25%. But FX markets don’t simply trade on absolute levels—they react to policy direction and forward momentum.

From that perspective, the divergence is telling. The Fed’s cut signals a pivot toward easing, while the BoC’s hold suggests a more patient, possibly firmer stance. That subtle shift has eroded the U.S. dollar’s perceived rate advantage and contributed to the recent rebound in the Canadian dollar.

That tilt is increasingly visible in the bond market. Since late November, Canada’s 10-year yield has climbed from 3.15% to around 3.44%, reflecting firmer pricing and less urgency around easing. U.S. yields have also moved higher, but more modestly—rising from 3.99% to about 4.15% over the same period.

Zooming out reveals a broader shift. At the start of 2025, the U.S. 10-year yielded 4.57%, while Canada’s was at 3.14%—a spread of 143 basis points. Today, that gap has narrowed to roughly 70 basis points, as Canadian yields have crept higher while U.S. yields have eased.

That compression matters. Yield differentials may not dictate intraday price action, but they serve as a key anchor for medium-term positioning, particularly for carry trades and rate-sensitive macro strategies. With the U.S.–Canada yield spread shrinking, one of the dollar’s core supports has weakened—leaving USD/CAD more sensitive to shifts in growth expectations, commodity trends, and broader risk sentiment.

Attention Shifts to January FOMC Meeting

Looking ahead to 2026, a key checkpoint for USD/CAD is the January 27–28 FOMC meeting. Futures markets currently price in roughly a 75% chance that the Federal Reserve will hold rates steady—suggesting a likely pause following December’s cut. But that expectation remains highly conditional.

Recent market action shows how quickly those odds can shift. In early December, traders leaned toward a hold—until softening labor data forced a rapid repricing. A similar setup now applies. With inflation and employment data still in flux, even modest surprises could reshape the policy outlook heading into January.

For USD/CAD, this reinforces a broader shift: the pair is no longer moving purely on rate differentials, but on relative economic resilience. If U.S. data continues to deteriorate, the dollar could face renewed pressure. If growth stabilizes, expectations for further easing may be dialed back.

While the FOMC meeting is the next known key checkpoint, it’s not the only potential catalyst. Unknown announcements—such as a Supreme Court ruling on U.S. tariffs—could also drive meaningful moves in the forex market. In that sense, January’s FOMC meeting should be seen more as a marker of evolving expectations than a final destination.

Tariff Reversal Could Benefit Canadian Dollar

Beyond central banks, trade policy remains one of the most critical wildcards in the currency landscape. The setup is reminiscent of what markets experienced in the spring of 2025. When Trump-era tariffs were announced, USD/CAD surged as traders reacted to rising trade tensions, concerns about global growth, and a flight to the safety of the U.S. dollar. But that spike proved short-lived. As the initial shock faded, USD/CAD reversed course and drifted lower through the summer, with macro fundamentals gradually reasserting control.

Now, a forthcoming U.S. Supreme Court ruling on the legality of those tariffs could trigger a similar aftershock—only in reverse. If the Court overturns part or all of the existing tariff framework, it could ease trade tensions, lift global risk sentiment, and support pro-cyclical currencies like the Canadian and Australian dollars. But the reaction is unlikely to be one-directional or sustained without caveats.

Even if the current structure is struck down, the White House is widely expected to pursue new tariffs under alternative legal justifications. That political overhang limits how much conviction traders can place in any immediate repricing. As such, any CAD strength tied to tariff relief could be swift but fleeting, depending on the language of the ruling and the speed of the policy response that follows.

Rising Volatility Adds to USD/CAD Appeal

Another reason USD/CAD is drawing attention heading into early 2026 is its volatility profile. While volatility across many of the key currency pairs has compressed in recent months, USD/CAD is one of the few showing expanding realized movement.

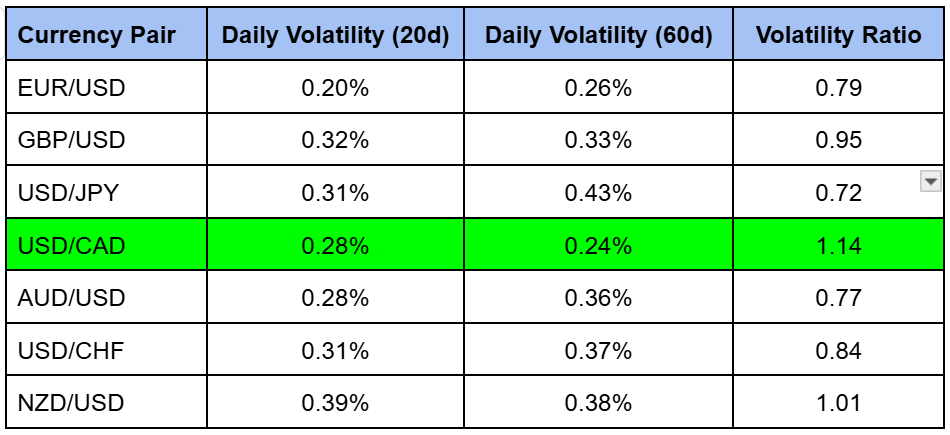

Analyzing the past 20 trading days, USD/CAD’s daily volatility sits around 0.28%, compared with 0.24% over the past 60 days—yielding a volatility ratio of 1.14. That makes it one of the only major currency pairs where near-term volatility is running above its longer-term average (highlighted below). In contrast, pairs like EUR/USD, AUD/USD, and USD/JPY have seen near-term volatility run below their longer-dated averages.

As the table shows, USD/CAD is bucking the broader trend. While many major currency pairs have seen volatility compress, USD/CAD is exhibiting increased realized movement—an important signal for traders focused on execution, event-driven setups, and directional opportunity.

That increased activity improves the potential for more frequent, meaningful price swings around macro data and policy decisions. And with a 2% margin requirement on tastyfx, USD/CAD remains a capital-efficient way to stay engaged with evolving catalysts—especially in a market where actionable movement has grown harder to find.

In sum, with macro risks building and realized movement on the rise, USD/CAD stands out as a currency pair where near-term catalysts could drive substantial price movement.