Tariff Risk or Relief? AUD/USD Could Move on Supreme Court Ruling

AUD/USD tests 2025 highs as widening yield spreads favor the Aussie. A looming Supreme Court tariff ruling could be the catalyst that breaks the range.

.jpg?format=pjpg&auto=webp&quality=90&width=820&disable=upscale)

Key Points

- AUD/USD has rebounded toward 0.6640, testing the upper end of its 2025 range.

- The Reserve Bank of Australia (RBA) held rates steady at 3.60% on December 9, while keeping the door open to future tightening in 2026. Meanwhile, markets have already priced in a 25-basis-point cut from the U.S. Federal Reserve at its December 10 meeting, reinforcing the widening yield gap in Australia’s favor.

- The upcoming U.S. Supreme Court ruling on Trump-era tariffs could be a key near-term catalyst. A reversal of the tariff policy could spark a risk-on rally in AUD/USD, while a decision to uphold the tariffs would probably keep the pair anchored to the existing paradigm.

- China remains a swing factor. Even modest signs of economic recovery—such as improving consumer demand or industrial activity—could boost Australia’s export outlook and reinforce the broader tailwinds driving AUD/USD higher.

After months of sideways trading, the Australian dollar is showing renewed strength. AUD/USD has climbed toward year-to-date highs, driven largely by a widening interest rate gap between Australia and the U.S.—with rising Aussie yields and a dovish Federal Reserve putting fresh wind at the currency’s back.

On December 9, the Reserve Bank of Australia (RBA) held rates steady at 3.6% in its final meeting of 2025. And as many expected, the RBA left the door open to additional rate hikes, particularly if inflation continues to run hot. That message helped reinforce the growing divergence between Aussie and U.S. yields—now one of the clearest drivers of AUD/USD momentum.

While that was an important development, a looming U.S. Supreme Court decision on Trump-era tariffs could prove even more consequential. With a 25-basis-point cut from the Federal Reserve widely expected on December 10, the real wildcard may be how the Court rules—and how markets respond.

Widening Yield Spread Boosts AUD Appeal

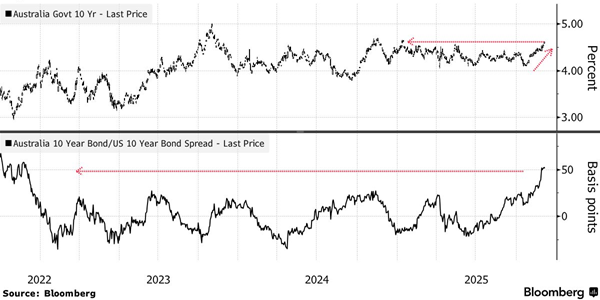

The bond market has been a key driver of the Aussie’s recent momentum. Over the past 40 days, Australia’s 10-year yield has surged—from around 4.10% in late October to 4.73% today. That breakout reflects growing confidence that Australian rates will stay elevated well into 2026. Combined with softer U.S. yields, it’s helped tilt the rate differential sharply back in the Aussie’s favor.

In contrast, the U.S. 10-year Treasury yield has only edged up—rising modestly from 3.96% to 4.14% in recent weeks, and still sitting far below the 4.60% highs seen earlier this year. As a result, the spread between Australian and U.S. yields has widened considerably—from just 16 basis points in late October to roughly 58 basis points today. That divergence makes the Aussie more attractive from a yield differential standpoint.

This week’s policy backdrop added another layer to AUD/USD’s momentum. As widely expected, the Reserve Bank of Australia (RBA) left its cash rate unchanged at 3.60% on December 9. What stood out was the tone: the statement leaned mildly hawkish, warning that officials aren’t ready to ease and could even consider further tightening in 2026 if inflation stays persistent.

The Federal Reserve, meanwhile, is headed in the opposite direction. The market is expecting a 25-basis-point rate cut at the December 9–10 meeting, reinforcing the view that the U.S. has already entered the early stages of an easing cycle. With U.S. yields softening and Australian yields climbing, capital appears to be rotating toward the higher-yielding currency—in this case, the Aussie.

Technicals have also turned more favorable for the Australian dollar. AUD/USD has pushed back into the upper end of its 2025 range and is now pressing into the same congestion zone that capped the September rally. A clean break above that band could open the door to a broader move—especially if the tariff decision delivers a fresh catalyst.

And that decision is coming soon. The U.S. Supreme Court’s ruling on the Trump-era tariff package could reshape global risk appetite—and ultimately determine whether AUD/USD breaks higher, or stays trapped in the narrow range that has defined this pair’s trading behavior through the second half of 2025.

Why the Tariff Decision Looms Large for AUD/USD

The ghost of tariffs past still haunts AUD/USD. Back in April, the pair sank to its 2025 low after Trump’s ‘Liberation Day’ tariffs reignited fears of a global trade clash. Now, with the U.S. Supreme Court set to rule on their legality, another major macro shock could be on deck.

The shockwaves from April still frame today’s setup. Trump’s sweeping tariff package detonated across global markets—hammering China and triggering a swift, disorderly selloff in the Australian dollar. Because Australia’s economy is tightly linked to Chinese demand—especially for commodities—AUD quickly became a clean proxy for tariff anxiety and a liquid way for investors to express views on Asia’s growth outlook.

Back in April, the AUD/USD collapsed through the 0.60 level for the first time since the COVID era, marking its sharpest single‑day decline since the 2008 financial crisis. Analysts called it a textbook risk‑off cascade: equities slid, volatility spiked, and traders dumped the Aussie in size as they braced for a deeper Chinese slowdown. In effect, global investors weren’t just selling Australia—they were using AUD as the vehicle to short China’s trajectory.

That episode effectively cemented the bottom of the pair’s five-year range, which has run between roughly 0.60 and 0.79. But in 2025, the tradable band has been far tighter—0.60 to 0.67—with April marking the defining extreme. Of late, it’s been a slow rebuild toward the middle of that longer-term range. That context is important because the next major catalyst could finally push AUD/USD away from its mid-year equilibrium.

If the Court overturns all or part of the tariffs, AUD/USD could experience the inverse of April’s collapse: a swift, risk-on repricing that propels the Aussie back toward the upper half of its five-year range—potentially at or above 0.70. If the Court upholds the tariffs, however, the existing paradigm likely stays in place. Under that scenario, global growth expectations may remain muted, and Australia’s China-linked exposure could continue to act as an anchor rather than a tailwind.

The ruling is almost certain to ripple through global markets, including forex. Just as April’s tariff shock dragged AUD/USD lower, the Supreme Court’s decision—whether it lands in December or early next year—could deliver an equally powerful jolt in the opposite direction.

Where AUD/USD Goes From Here

After a modest breakout, AUD/USD is once again pressing against the top of its multi-month trading band. Australian yields have risen sharply, shifting the rate differential in favor of the Aussie. But as yet, that hasn’t been enough for AUD/USD to punch through strong resistance at the 0.66-0.67 level.

That’s what makes the Supreme Court’s upcoming tariff ruling so consequential. It’s a catalyst capable of snapping AUD/USD out of its rangebound drift. If the Court strikes down part or all of the Trump-era tariffs, it could trigger a swift re-rating of global growth expectations and boost risk appetite—potentially lifting the Aussie, given its strong trade ties with China.

If the tariffs stand, however, the current macro backdrop likely persists. That would keep AUD/USD tethered to familiar drivers: yield spreads, central bank expectations, and day-to-day shifts in sentiment. A Fed cut might offer marginal upside—but maybe not enough, on its own, to push the pair back above 0.70.

The other swing factor is China. Any sign of stabilization—whether in consumer demand, industrial production, or broader sentiment—has the potential to provide the Aussie with a more durable tailwind. Even modest “green shoots” from Beijing, if paired with a favorable Supreme Court decision on tariffs, could accelerate momentum in AUD/USD.