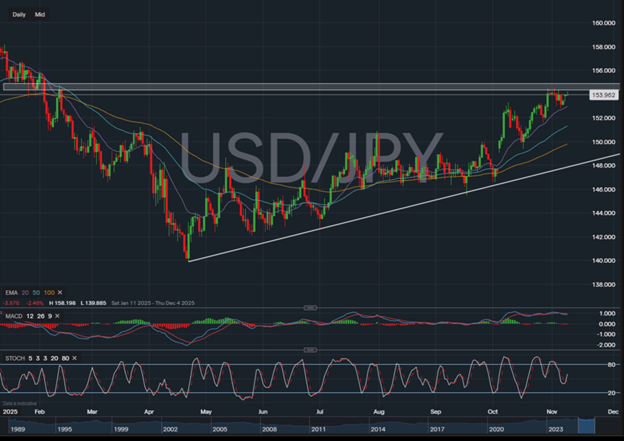

USD/JPY Consolidating Below Resistance Near 155

USD/JPY rates are at their highest levels since February.

USD/JPY is starting the week on slightly stronger footing in the wake of the news that a tentative deal had been reached in the U.S. Senate to end the longest government shutdown in history. While the U.S. Dollar has firmed versus most of its counterparts, the downdraft in U.S. Treasury yields over the morning session on Monday has allowed the Japanese Yen to recoup some losses. On the Yen side, Japanese government bond (JGB) 10-year yield reached its highest level since June 2008 as fiscal concerns mount across the Pacific.

USD/JPY price history

In the above chart, USD/JPY rates have struggled to breach the February 2025 swing high near 155, having paused below said resistance since late-October. That said, momentum remains to the upside, with USD/JPY well-supported by uptrends in both the 20-day exponential moving average (EMA) and 50-day EMA. A breach of 155 would suggest continuation to the upside back to the 2025 highs would be in focus; a drop below the 20-day EMA would initially expose the late-October swing low below 152.

Trading forex requires an account with a forex provider like tastyfx. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them.