USD/JPY Facing Intervention Risk?

As USD/JPY rates continue to climb past key psychological price level, Japanese officials are issuing warnings.

The USD/JPY pair is trading around 155.40 today as the dollar gains ground against the yen amid a shift in risk sentiment and fading expectations of a near‑term rate cut by the Federal Reserve. The yen recovered slightly but remains under pressure after the pair hit multi‑month highs near 155.90; Japanese officials are signaling concern over the weakness and rising volatility in the currency market. So while the Yen has room to weaken on the back of rate differentials and fiscal consternation in Japan, further the risk of Japanese FX intervention is increasing, which could act as a ceiling on upside for the pair.

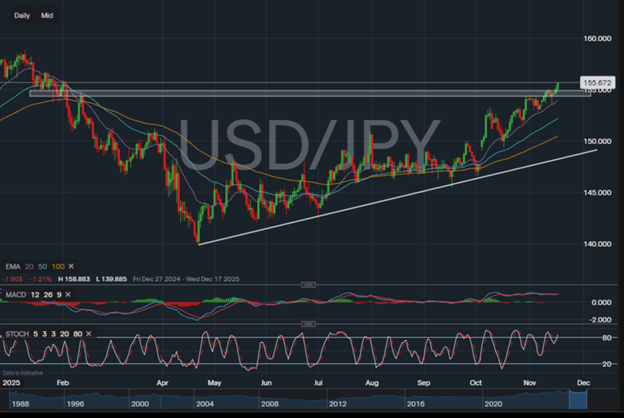

USD/JPY Daily Price History

In the above chart, USD/JPY rates have finally breached the February 2025 swing high near 155, the culmination of a two-week effort to scale resistance. Momentum continues to point higher, with USD/JPY well-supported by its 20-day exponential moving average (EMA) on pullbacks. The 2025 high at 158.88 is now in focus; a drop below the 20-day EMA would suggest that the rally has run out of steam.

Trading forex requires an account with a forex provider like tastyfx. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them.