USD/JPY Rebound Puts Yearly Highs in Focus

USD/JPY has benefited from the bump in U.S. Treasury yields.

USD/JPY has erased the past two weeks of losses amid a shift in U.S. Treasury yields. While Fed rate cut odds are pointing to a near-certainty of a 25-bps rate cut on Wednesday, traders have been reducing expectations for cuts over the course of 2026, with just two discounted at this time. Long-end U.S. yields (10-year, 30-year) have started to show signs of breaching their downtrends in place since May. On the other side of the December FOMC meeting, traders should be reminded of potential Japanese intervention risk given recent commentary from officials.

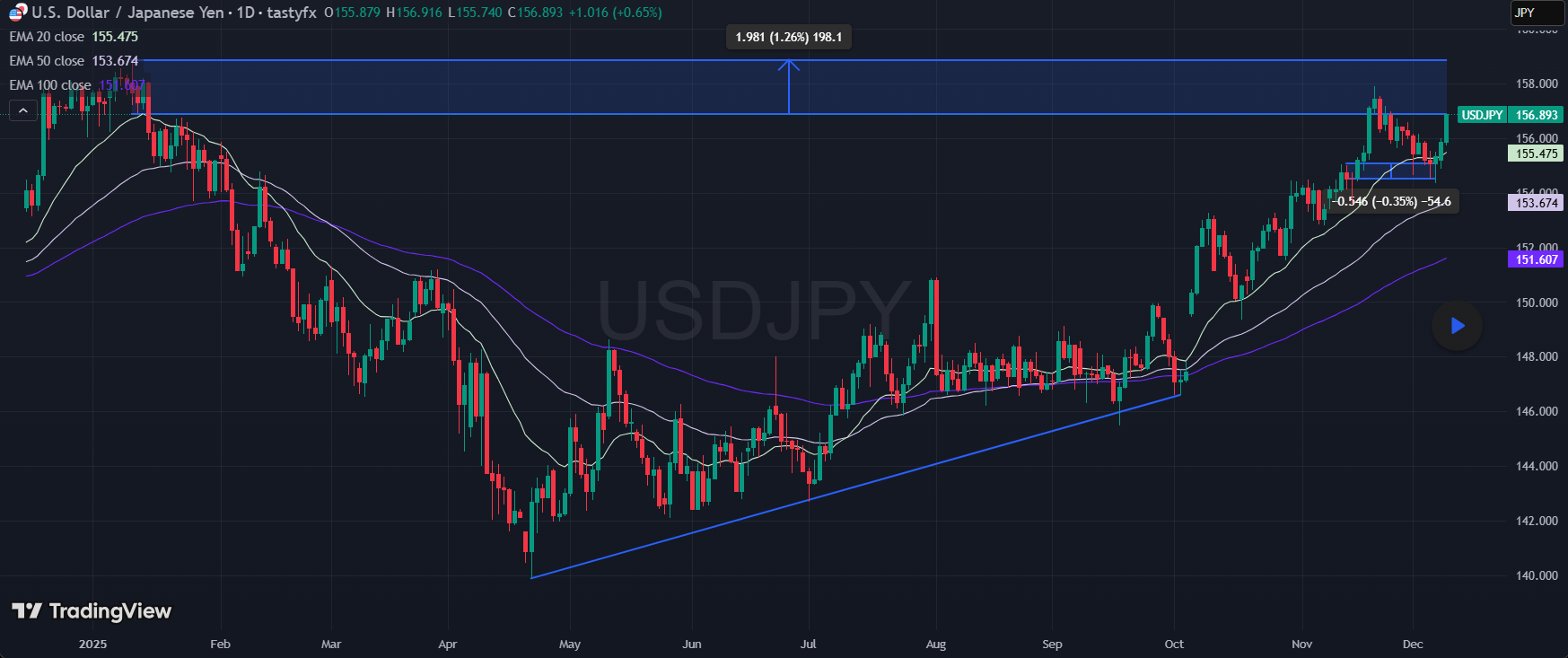

USD/JPY Daily Price History

In the above chart, USD/JPY rates found support at the February and October swing highs near 155, a clean evolution of zone from resistance into support. Momentum is once again pointing higher following a break of the downtrend off the November high, with each of the 20-day exponential moving average (EMA), 50-day EMA, and 100-day EMA having positive rates of change. The 2025 high at 158.88 is in focus.

Trading forex requires an account with a forex provider like tastyfx. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them.