USD Outlook Hinges on Two Near-Term Catalysts

Learn what's likely to drive dollar volatility amid murky US data and oscillating risk sentiment.

Key Points:

- With the dollar under pressure for most of 2025, two upcoming catalysts—a Supreme Court tariff ruling and the December Fed meeting—are likely to play an outsized role in shaping FX sentiment heading into 2026.

- Futures markets currently indicate the Fed is more likely to cut rates in December, but expectations remain extremely fluid and could shift quickly as new data arrives. A tariff ruling that lands before the meeting could also influence central bankers as they finalize their decision.

- With event risk elevated and the timing of the tariff ruling still unknown, volatility in major currency pairs may rise as traders navigate one of the most pivotal stretches of 2025.

After a year of pressure, the U.S. dollar now approaches a critical period that should set the tone for how it finishes 2025.

Two catalysts—one unscheduled and highly unpredictable, the other firmly on the calendar—now sit directly in front of the market. The first is a pending Supreme Court ruling on presidential tariff authority, a decision that could meaningfully alter global risk sentiment. The second is the Federal Reserve’s December 9–10 policy meeting, where officials remain sharply divided over whether to hold rates steady, or cut them again.

Either event has the potential to influence sentiment across the global forex landscape. Together, they create an unusual convergence of policy risk that leaves markets acutely sensitive to any shift in tone. For FX traders, the timing and messaging around these catalysts may matter as much as the decisions themselves—especially in a market still recalibrating after a year of persistent dollar softness.

Given its depth and central role in global currency flows, EUR/USD will be a primary barometer for how these catalysts ripple through the broader FX landscape.

Imminent Tariff Ruling Could Affect Policy Expectations and Impact FX Sentiment

Among all the moving pieces shaping year-end FX sentiment, the Supreme Court’s pending tariff decision stands out as the most unpredictable.

The ruling will determine whether the president can impose tariffs under emergency economic powers without explicit approval from Congress—an outcome with direct implications for trade policy, growth expectations, and rate-cut odds. Adding to the uncertainty, the timing is completely unscheduled, leaving markets without a reliable window for when the decision might arrive, an unusual challenge for currency traders who typically anchor risk around fixed events.

The exact market reaction is hard to pinpoint ahead of time, but two broad scenarios stand out—each with potential implications not just for the dollar, but also for how the Federal Reserve may approach policy at its December meeting.

If the Court invalidates President Trump’s tariff authority, markets may interpret the decision as a reduction in policy risk. With less uncertainty around trade, business and consumer sentiment could improve, potentially supporting stronger economic growth. In that scenario, the Fed may feel less pressure to cut rates, reinforcing the dollar’s interest-rate advantage.

On the other hand, if the Court upholds the tariff authority, the opposite dynamic may emerge. Even without immediate new tariffs, the possibility of future trade barriers could weigh on business investment, raise import costs, and increase downside risks to growth. The Fed could view that as an additional reason to lean toward easing policy, particularly if confidence or hiring softens. That path would likely pressure the dollar—both through weaker sentiment and increasing rate-cut expectations.

For traders, the most challenging element is the unpredictability of both timing and market interpretation. A ruling before the Fed meeting could materially shape expectations going into December 9–10, whereas a ruling that arrives after the December Fed meeting could amplify—or counteract—the Fed’s message.

A Divided Fed Prepares for a Pivotal December Meeting

Amid the uncertainty surrounding the tariff ruling, the Federal Reserve’s December 9–10 meeting stands out as one of the month’s defining events—and a key pivot point for currency markets.

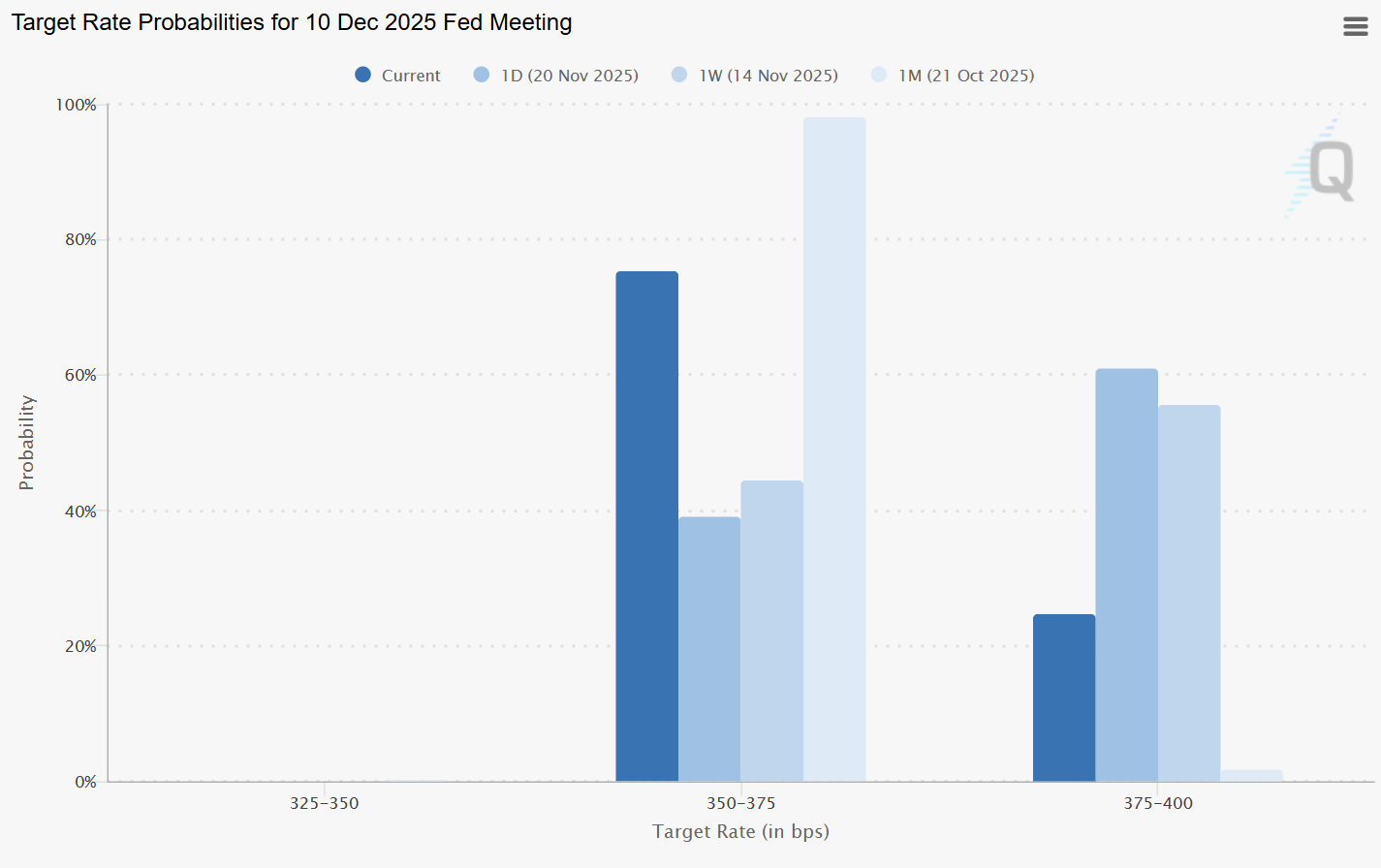

For most of November, rates markets were nearly evenly split, pricing roughly a 51% chance of a hold at 3.75%–4.00% and a 49% chance of a quarter-point cut to 3.50%–3.75%. That balance reflected a Fed navigating two competing realities: inflation that has stayed stubbornly high, paired with labor-market indicators that continue to soften at the margins.

However, that 50/50 setup shifted abruptly with the release of the Fed minutes on the afternoon of Nov. 19. Traders viewed the minutes as more cautious on further easing, pushing market-implied odds of a December hold to nearly 70%—a meaningful repricing driven by persistent inflation and a committee wary of moving too quickly. But that shift didn’t last long.

The stock market sold off sharply on Nov. 20, and risk sentiment deteriorated, pushing the chances of a hold back down to 60% and underscoring how sensitive the outlook remains to incoming data and broader market conditions. This morning alone sentiment has flipped to favor a rate cut, moving the odds over 20% in less than a day. The current outlook, which remains highly fluid, is highlighted below.

The Fed minutes made one point especially clear: inflation hasn’t been fully contained. Several officials argued that disinflation has “stalled,” warning that another cut could reinforce stubborn price pressures or raise doubts about the Fed’s commitment to the 2% goal. On the other side of the debate, those leaning toward a cut highlighted mounting labor-market risks and the need to guard against a faster-than-expected rise in unemployment.

What complicates this December decision is that the Fed may not be operating in a vacuum. A tariff ruling that lands before December 9–10 could influence how policymakers weigh the arguments already dividing the committee.

If the Supreme Court invalidates tariff authority, central bankers may view the decision as reducing downside risks to growth. With trade uncertainty diminished and supply-chain pressure easing, the Fed could feel less urgency to deliver another cut. In the context of the Nov. 19 minutes—which already showed rising concern that disinflation has stalled—such a ruling would tilt the committee further toward holding. In FX terms, that dynamic would support the dollar through firmer near-term rate expectations.

If the Court upholds the authority, the Fed could face a different backdrop entirely. Even without immediate new tariffs, the prospect of future trade frictions may weigh on business confidence and increase the risk of slower hiring or higher import prices. Policymakers worried about labor-market fragility could see that as an additional reason to favor easing. A ruling of this kind would raise the odds of a 25 bp cut and likely add pressure to the dollar through softer rate expectations.

Setting the tariff-related spillover aside, the FX implications of the Fed’s own decision remain relatively straightforward.

A hold would likely firm the dollar at the margin. Even without overtly hawkish messaging, maintaining current rates would keep U.S. yield spreads from narrowing further, especially now that markets view a hold as the base case after the Fed minutes. The committee may emphasize data uncertainty from the government shutdown or stress the need for patience—both of which typically favor the dollar.

A rate cut would almost certainly weigh on the dollar. By lowering the return on dollar-denominated assets, a cut would boost the relative appeal of higher-yielding foreign currencies. If Powell highlights labor-market risks or hints at the possibility of further easing in early 2026, the market reaction could be sharper. EUR/USD tends to move quickly on shifts in Fed expectations, and even a modestly dovish tone would likely support further upside in the pair.

EUR/USD Braces for a High-Volatility Stretch

With both catalysts outlined, EUR/USD returns to center stage. The euro has posted a robust advance in 2025, rising from a late-2024 low near 1.03 to around 1.16 as of mid-November. While the pair has eased slightly from last week’s highs amid firmer U.S. dollar sentiment, the broader uptrend remains intact. That move places EUR/USD in the upper third of its five-year range between roughly 0.97 and 1.22—an area where upward momentum has often slowed in the past.

The advance reflects a mix of structural and cyclical drivers: persistent U.S. dollar softness, narrowing yield differentials, and a steadier macro backdrop in Europe. But over the coming weeks, the pair’s direction will depend less on eurozone fundamentals and more on how U.S. policy expectations shift in response to the Supreme Court ruling and the December Fed meeting.

If the Court invalidates tariff authority and the Fed leans toward holding rates steady, the dollar could firm. A ruling that reduces trade uncertainty would improve the economic outlook and leave the Fed with less incentive to ease further—conditions that could pull EUR/USD back toward 1.12–1.14.

Alternatively, if the Court upholds tariff authority and the Fed signals a willingness to cut, the dollar could come under renewed pressure. Under that combination, EUR/USD may push toward resistance near 1.18–1.20, levels last seen in early 2021.

If the catalysts arrive in different sequences or deliver conflicting signals, EUR/USD could swing more erratically within the 1.14–1.18 band as traders react to rapid shifts in rate expectations and incoming U.S. data.

For now, EUR/USD sits at a meaningful inflection point: supported by year-long macro trends but increasingly sensitive to policy shocks. With two major catalysts approaching, the pair is likely to remain one of the most closely watched benchmarks as global markets navigate the final weeks of 2025.

What to Watch as the Catalysts Approach

The next several weeks will determine how the dollar closes out the year. The biggest variable is timing: a Supreme Court ruling that lands before the Fed meeting could reshape expectations heading into December 9–10, while a ruling that arrives afterward may amplify—or counteract—the Fed’s message. For USD pairs, especially EUR/USD, that sequencing risk alone raises the odds of abrupt, headline-driven volatility.

With both catalysts still in play and directionally meaningful, EUR/USD remains highly sensitive to policy signals. For traders, patience may prove valuable: waiting for a clearer break in momentum—either above recent highs or back toward mid-range support—can help avoid getting caught on the wrong side of a fast-moving, catalyst-driven swing.

For now, the pair sits at a critical juncture, ensuring it will remain one of the most closely watched benchmarks as markets navigate the final stretch of 2025.

Trading forex requires an account with a forex provider like tastyfx. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them.