Volume-Based Rebates: How to earn more cashback the more you trade

Turn forex trading costs into cashback. tastyfx VBR Program returns 2.5-15% of spreads with a low $1M notional monthly threshold. Start earning rebates today.

Managing costs is one of the most overlooked aspects of trading performance. While strategies and market timing often take center stage, the reality is that transaction costs—spreads, commissions, and fees—play a major role in shaping net returns. For active traders, finding ways to reduce these costs can be just as important as finding the next profitable setup.

That’s where the tastyfx Volume-Based Rebate (VBR) Program comes into play—giving traders a practical way to recapture value from every trade.

What Are Volume-Based Rebate (VBR) Programs?

In forex trading, execution costs add up quickly. Spreads—the small difference between the bid and ask price—are paid on every trade, and those fractions of a pip can have a meaningful impact on long-term returns.

That’s where Volume-Based Rebate (VBR) programs come in. These programs reward traders for activity by returning a percentage of the spread they’ve already paid. Think of it as cashback for trading: the more you trade, the more savings you earn back.

Historically, these rebates have been designed with institutional desks or very high-volume accounts in mind. The thresholds to qualify were so steep—often $10M to $50M in monthly notional. As a result, most traders were left out. The tastyfx VBR Program expands on that model—opening the door for more traders to turn everyday activity into meaningful cashback.

How the tastyfx VBR Program Works

tastyfx’s Volume-Based Rebate (VBR) program is straightforward: it rewards traders with a percentage of the spread they’ve already paid, based on cumulative monthly notional trading volume across all eligible accounts. In other words, the more volume you generate, the higher your rebate.

At the end of each month, tastyfx automatically tallies your volume and applies the correct rebate. Funds are credited to your account around the 5th of the following month, with no lock-up. You can withdraw your cashback immediately or put it back to work in the market.

Here’s what that means in practice:

Notional Trading Volume: The total dollar value of your executed trades—both opens and closes—calculated in USD over a calendar month. This figure determines which rebate tier you qualify for.

Spread: The cost built into every trade, measured as the difference between the bid (buy) and ask (sell) price. tastyfx applies half of that difference per side of the trade, which is the basis for calculating your spread cost.

Cashback Percentage: Your rebate rate, which increases as you move into higher monthly notional tiers—ranging from 2.5% up to 15%.

tastyfx VBR tiers

| Tier | Monthly Notional Value (USD) | Rebate (% of spread) |

| 1 | $1M-50M | 2.5% |

| 2 | $50M-100M | 5% |

| 3 | $100M-250M | 8% |

| 4 | $250M-500M | 10% |

| 5 | $500M+ | 15% |

Reaching $1 Million Notional Is Easier Than You Think

Thanks to leverage, achieving $1 million in notional volume doesn’t mean you need $1 million in cash. An example* is highlighted below using the USD/CAD (U.S. dollar / Canadian dollar) currency pair:

1 standard lot = $100,000 notional value (requires approximately $2,000 margin at 50:1 leverage)

Open 5 standard lots total during the month = $500,000 notional

Close those 5 lots = another $500,000 notional

Total Monthly Notional = $1 million

Whether you trade those 5 lots all at once, 1 lot five times, or 0.01 lots 500 times, it all counts toward your cumulative monthly volume for rebate purposes.

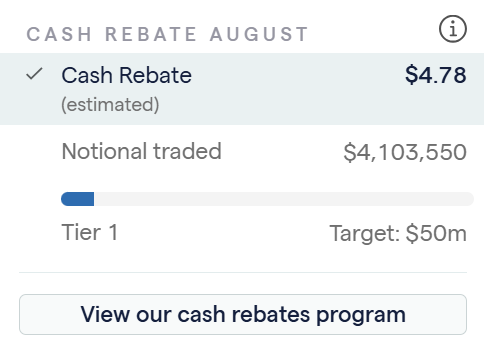

In the tastyfx platform, you can track your progress directly from the Balances Dropdown for insight into your notional volume and indicative rebate amount month-to-date.

Hypothetical Cashback Scenarios at the 2.5% Tier 1 Rate

The table below shows how monthly and annual cashback could look for different account sizes at the Tier 1 rebate level (2.5% cashback on the spread for $1–$50 million in monthly notional volume):

| Account Size | Monthly Notional Volume | Spread costs | Monthly Cashback | Annual Cashback |

| $1,000 | $1M | $100 | $2.50 | $30 |

| $5,000 | $5M | $500 | $12.50 | $150 |

| $10,000 | $10M | $1,000 | $25 | $300 |

| $25,000 | $25M | $2,500 | $62.50 | $750 |

The figures* above were calculated using the 2.5% rebate rate (Tier 1) and multiplying that by the spread costs for each example, as detailed below:

- $100 × 2.5% = $2.50 monthly cashback → $2.50 × 12 months = $30 annually.

- $500 × 2.5% = $12.50 monthly cashback → $12.50 × 12 months = $150 annually.

And so on for the higher volumes.

Account holders in Tiers 2, 3, 4, and 5 qualify for rebates of 5%, 8%, 10%, and 15%, respectively. These higher rebate levels can translate into substantially greater annual savings compared to Tier 1—potentially putting more dollars back into a trader’s account each year through cashback rebates.

Rebates Designed for Real-World Traders

By lowering the entry threshold to just $1 million in notional volume per month, tastyfx has turned the VBR program into a practical benefit for a much broader audience. You don’t need institutional scale to earn meaningful rebates—you just need to trade actively and consistently.

And when those rebates are layered on top of tastyfx’s zero commissions, tight spreads, and pro-level trading tools, the result is a trading environment where every trade costs less—and every dollar saved can be reinvested into future opportunities.

The hypothetical examples below show that even moderate trading activity can exceed the $1 million notional threshold, qualifying an account for cashback under the expanded program.

Example 1: Forex Day Trader

- Trades 2–3 standard lots per day in EUR/USD (euro / U.S. dollar)

- 20 trading days × 2.5 lots = 50 lots total (≈ $5 million notional)

- Qualifies for $12.50 monthly cashback at Tier 1 (2.5%)—or $150 annually.

Example 2: Forex Swing Trader

- Opens 5-lot positions in GBP/USD (British pound / U.S. dollar) twice per week

- 8 trades × 5 lots = 40 lots total (≈ $4 million notional)

- Qualifies for $10 monthly cashback—or $120 annually

How the tastyfx VBR Program Stacks Up Against the Competition

- tastyfx: With the threshold set at $1 million notional per month, rebates are within reach for a much wider pool of active traders.

- Oanda: Rebate starts at $10 million notional per month.

- Forex.com: Rebate starts at $50 million notional per month.

The Bottom Line

At its core, the tastyfx VBR program is about efficiency—transforming routine trading activity into added value. By converting spread costs into a source of return, it moves rebates from a simple perk to a built-in advantage within a trader’s broader strategy.

What makes this powerful is its consistency. Markets are unpredictable, but rebates deliver a benefit traders can count on—month after month, trade after trade. That steady stream of savings compounds over time, helping active traders stretch their capital further and reinforcing the idea that every position isn’t just a risk, but also an opportunity to recapture value.

The more you trade, the more you keep.

*These examples are for illustrative purposes only. Actual rebates may vary. Trading forex on margin carries significant risk, losses may exceed deposits.