Weak U.S. Labor Market Emerges as Key Risk for Dollar Outlook in 2026

The dollar shook off slower hiring in December, but future employment figures may be a critical catalyst in the dollar's year ahead.

.jpg?format=pjpg&auto=webp&quality=90&width=820&disable=upscale)

Key Points:

- The U.S. dollar enters 2026 on fragile footing after a challenging 2025 marked by Fed rate cuts, shifting risk sentiment, and trade-related headwinds.

- With inflation easing slightly, the labor market has taken center stage as a near-term driver of policy expectations, with December’s jobs report showing just 50,000 new payrolls and downward revisions to prior months.

- If employment trends deteriorate further, expectations for faster Fed cuts may intensify—amplifying bearish pressure on the dollar.

The outlook for the U.S. dollar remains cautious heading into early 2026. After a difficult 2025—pressured by a dovish Fed pivot, shifting risk sentiment, and escalating trade frictions—the greenback starts the year on weak footing.

While a wide range of macro forces continue to shape the broader forex landscape, one of the most critical near-term variables is the U.S. labor market. If job growth slows meaningfully or turns negative, the Fed could be forced to accelerate rate cuts—putting additional downward pressure on the dollar.

Inflation remains a factor to monitor, but with the December data largely in line with expectations, labor market momentum is increasingly taking center stage in shaping near-term policy expectations.

Labor Market Slippage Emerges as Key Risk in 2026

The December 2025 jobs report, released January 9, delivered more evidence that the U.S. labor market is losing momentum.

The economy added just 50,000 jobs last month, closing out a year that saw only 584,000 net payroll gains—the softest annual performance since 2003 (excluding recessions). To compound the disappointment, October and November’s payroll figures were revised lower by a combined 76,000 jobs, and further downward adjustments could be forthcoming.

This trend matters because the Federal Reserve doesn’t just manage inflation—it also has a mandate to support employment. If job growth stalls or turns negative, the Fed may feel compelled to accelerate rate cuts, even if inflation remains somewhat elevated. A contracting labor market gives policymakers cover to shift their focus, and such a pivot would likely weaken the U.S. dollar.

Conversely, if the labor market shows signs of resilience—holding steady or strengthening modestly—the Fed may stick to a more cautious easing path. Even with a dovish successor set to take over the chair, persistent inflation pressures would limit how far and fast the central bank is willing to cut, helping to support the dollar against lower-yielding currencies.

The trajectory of U.S. job growth is quickly becoming the dominant force shaping the dollar’s path in Q1. With inflation data softening and policy attention shifting toward economic resilience, the labor market now holds the key to rate expectations—and, by extension, FX direction. In early 2026, few indicators carry more weight than U.S. employment.

Why the Dollar’s Fate May Rest on U.S. Job Growth

Because of the Fed’s dual mandate, monetary policy in the United States must strike a balance between price stability and full employment.

With inflation cooling slightly in late 2025, market attention is shifting toward the employment side of the mandate. If job growth stalls—or worse, turns negative—the Fed could come under renewed pressure to accelerate rate cuts, even if inflation remains modestly above target. That pivot could weaken the dollar, particularly if other central banks stay on hold or move more cautiously.

On the other hand, if job creation holds steady or accelerates, the Fed may feel less urgency to ease. Resilient employment would give policymakers cover to take a slower, more measured path to rate cuts. That would likely keep U.S. yields higher relative to global peers and continue to support the dollar. A strong labor market also signals that the economy can absorb tighter financial conditions longer than expected, allowing the Fed to maintain its inflation-fighting posture.

As a result, the direction of U.S. job growth looks increasingly pivotal in shaping early 2026 policy expectations—and with them, the path of the U.S. dollar. In a market acutely sensitive to Fed signals, few data points carry more immediate weight than the monthly employment report.

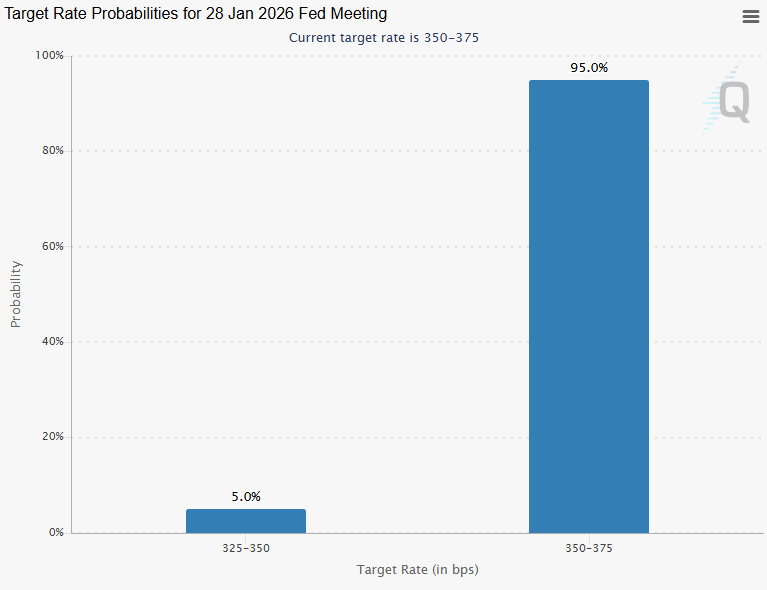

Futures markets currently assign a 95% probability to the Fed keeping rates unchanged at its upcoming January meeting, as illustrated below.

The Contrarian View: Why the Dollar Could Still Rally

While a weakening U.S. labor market typically spells trouble for the dollar, there’s a scenario where global conditions flip the script. If economic weakness spreads beyond the U.S.—dragging down growth in Europe, Asia, or emerging markets—the dollar could strengthen on a relative basis. In times of global strain, capital often flows toward perceived safety, and the dollar’s status as the world’s reserve currency and deepest capital market can quickly reassert its appeal.

This kind of “dollar exceptionalism” isn’t without precedent. We saw it in the mid-2010s and again after the pandemic began, when recession fears abroad pushed investors into dollar-denominated assets despite Fed easing. If global data starts to sour—especially outside the U.S.—safe-haven demand could override local labor weakness and support the greenback. In short, even a soft domestic jobs market doesn’t rule out a dollar rebound if the rest of the world starts to slip faster.

How to trade the US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. USD/JPY can be found in tastyfx's platform under the 'Major' pairs tab. Many traders also watch major forex pairs like GBP/USD and AUD/USD for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.