High-probability forex setups: trading the volatility squeeze

Explore current forex opportunities as USD volatility compresses, learn to leverage standard deviations for strategic trading, and discover why AUD/USD might outshine USD/JPY in today's market conditions.

High-Probability Forex Setups and Volatility Analysis

In recent weeks, forex markets have experienced unprecedented volatility, with the US dollar hitting levels not seen since the pandemic. FX volatility for major USD pairs reached multi-year highs last month due to the variety of high-impact trade developments, particularly noticeable in USD/CHF and AUD/USD, which saw a 20% volatility peak in April. However, USD ranges have compressed in the last week, suggesting a potential normalization to long-term market structures. As traders anticipate significant economic data releases this week, it's crucial to remain prepared for possible shifts and leverage historical volatility data to inform trading decisions.

US Dollar Volatility Is Falling

The recent compression in USD ranges points to a decline in volatility following last month's highs. This change could indicate a normalization back to long-term market structures as tariff headlines begin to lose gravity, offering a momentary pause amid typically major economic headlines. As traders adjust to these evolving conditions, the question remains whether this pause is temporary or reflects a more sustained shift. With the anticipation of significant economic data releases throughout May, traders must remain vigilant, using data-driven strategies to navigate potential volatility resurgences.

How Traders Use Standard Deviations

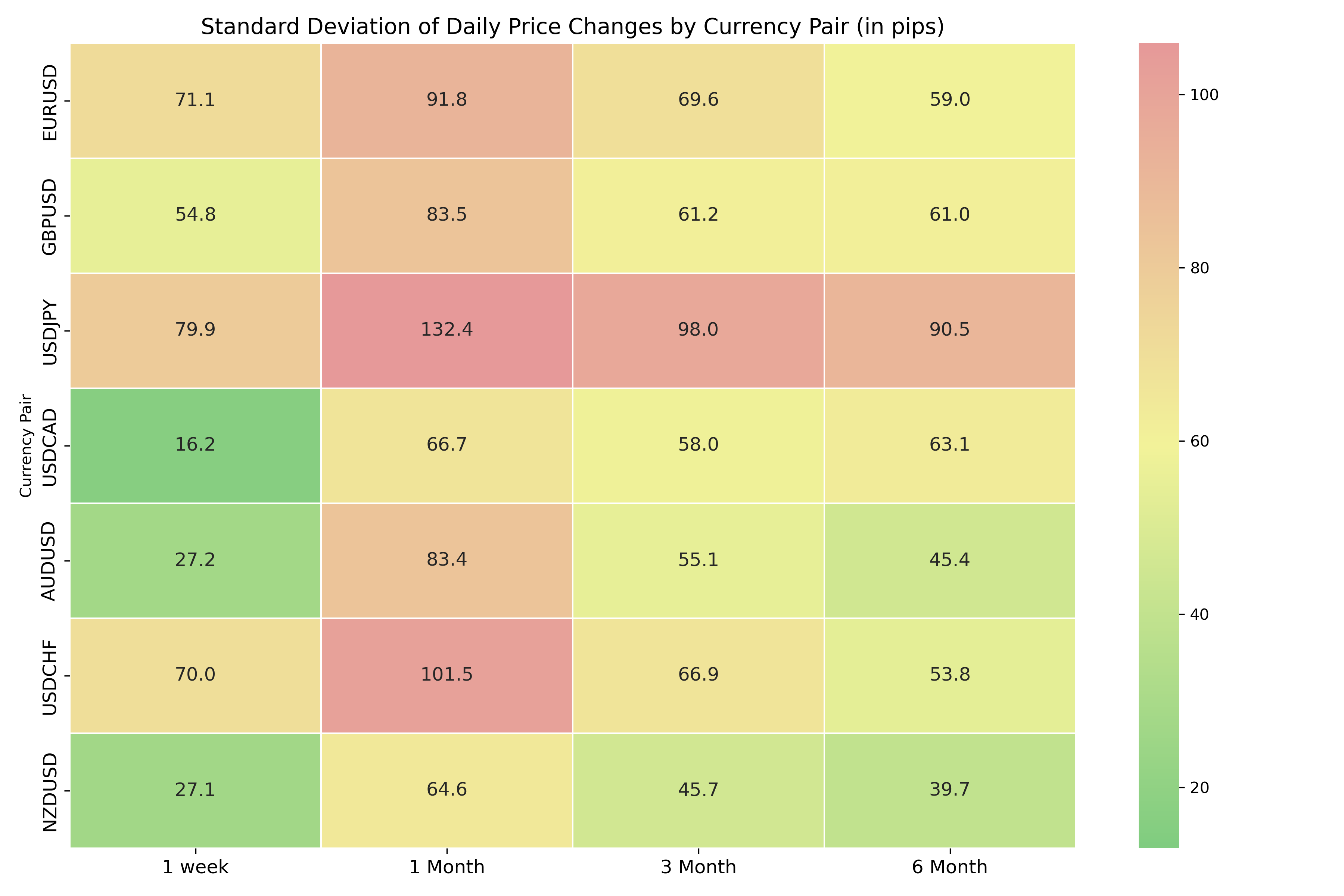

Standard deviation is a crucial tool for traders, measuring daily price ranges with 68% confidence and providing insight into market behavior. For example, 68% of historical daily close data for USD/JPY in the last three months was within a +/-098.00 range. Compare this range to the increased 1-month range (+/-132.40) and the compressed 1-week range (+/-079.90). This statistical measure aids traders in setting realistic entry and exit points, optimizing risk management strategies. By understanding standard deviation, traders can better navigate market boundaries, identifying when prices deviate from the norm and adjusting their strategies accordingly.

Key Considerations for Traders

Market dynamics in forex require consideration of factors like capital efficiency and trade size, especially when comparing pairs such as AUD/USD and USD/JPY. Different margin requirements and volatility levels affect potential profitability per pip, influencing trade sizing decisions. Present market conditions may render AUD/USD more attractive than USD/JPY, despite having almost half the daily range. This is because lower margin requirements (3% vs 5%) allow traders to put on greater position sizes with the same amount of capital - which can magnify movement per pip even though AUD/USD tends to move less per day. By tailoring trade size and understanding product specifications, traders can strategically position themselves to optimize returns while managing risks effectively.

FX pair | AUD/USD | USD/JPY |

Margin available | $5,000 | $5,000 |

Margin required | 3% | 5% |

Maximum trade size | 2.59 lots | 1 lot |

Dollars per pip | $29.5 | ~$7.05 |

Maximum profit/ loss per 1 STDEV move | $29.5/pip x 55 pips = $1,622.5 | $7.05/pip x 98 pips = $691 |

How to trade USD volatility

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Develop your trading strategy using analytical tools

- Open, monitor, and close positions on US dollar pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing. Past performance is not indicative of future results.