Forex Trading Costs, Fees & Spreads

tastyfx offers low forex trading costs including $0 commissions1, spreads starting at 0.8 pips, and competitive rollover rates on our 80+ pairs including some of the smallest overnight funding fees in forex.

Forex Spreads and Margins

Trade the biggest pairs with the lowest cost. Explore narrow forex spreads of 1.0 pips or less for several USD pairs.

Popular USD

AUD/USD

$10

1

3%

EUR/USD

$10

0.8

2%

GBP/USD

$10

1

5%

NZD/USD

$10

1.6

3%

USD/CAD

C$10

1.5

2%

USD/CHF

CHF10

1.5

3%

USD/JPY

Y1000

0.8

5%

Popular Non-USD

AUD/CAD

C$10

2.2

3%

AUD/JPY

Y1000

1.6

5%

AUD/NZD

NZD10

3.6

3%

EUR/AUD

AUD10

2.4

3%

EUR/GBP

£10

1

5%

EUR/JPY

Y1000

1.2

5%

GBP/JPY

Y1000

5%

NZD/CAD

C$10

4.5

3%

Forex Trading Costs & Fees

Our only cost to execute a forex trade is the spread, starting at just 0.8 pips, thanks to our $0 commission1 model. If you’re holding a position overnight, our competitive rollover rates include some of the lowest overnight funding fees in the US.

- Overnight funding fees

When you trade forex with us, you trade on margin. This means you provide a deposit to open a position, and we, in effect, lend you the rest of the money required. There is no funding fee if you close your position on the same day. If you keep it overnight, we charge a small fee to cover the cost of the money you've effectively borrowed. The fee is calculated as the tom-next rate plus a small admin fee. - Currency conversion charges

Trading forex pairs with a quote currency that isn't US dollar may incur a currency conversion charge. When a qualifying position is closed, the profit or loss is converted to US dollars with a 0.5% charge included.

1 tastyfx does not charge commissions. tastyfx is compensated through a hedging arrangement with IG Markets Ltd.

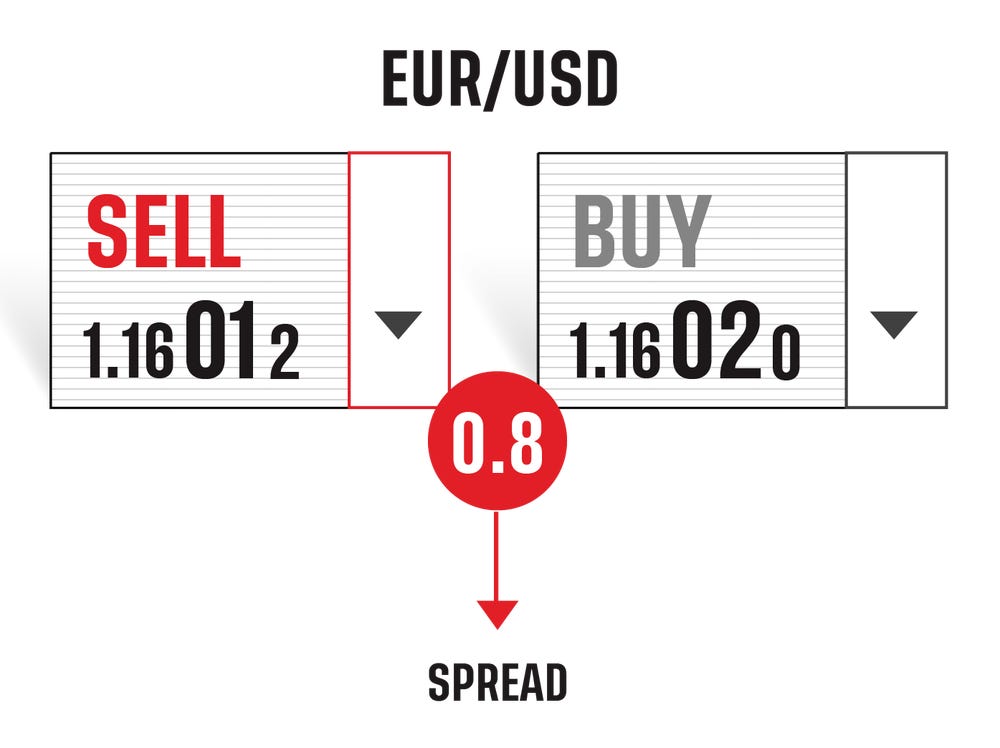

What is a spread in forex and how is it calculated?

The forex spread is the difference between the bid and ask prices, calculated: (ask price) – (bid price). At tastyfx, the spread is your only cost to execute a trade thanks to our $0 commission1 model. Spreads often depend on liquidity and volatility; for example, the highly liquid EUR/USD market can have as low a spread as 0.8 during active trading hours.

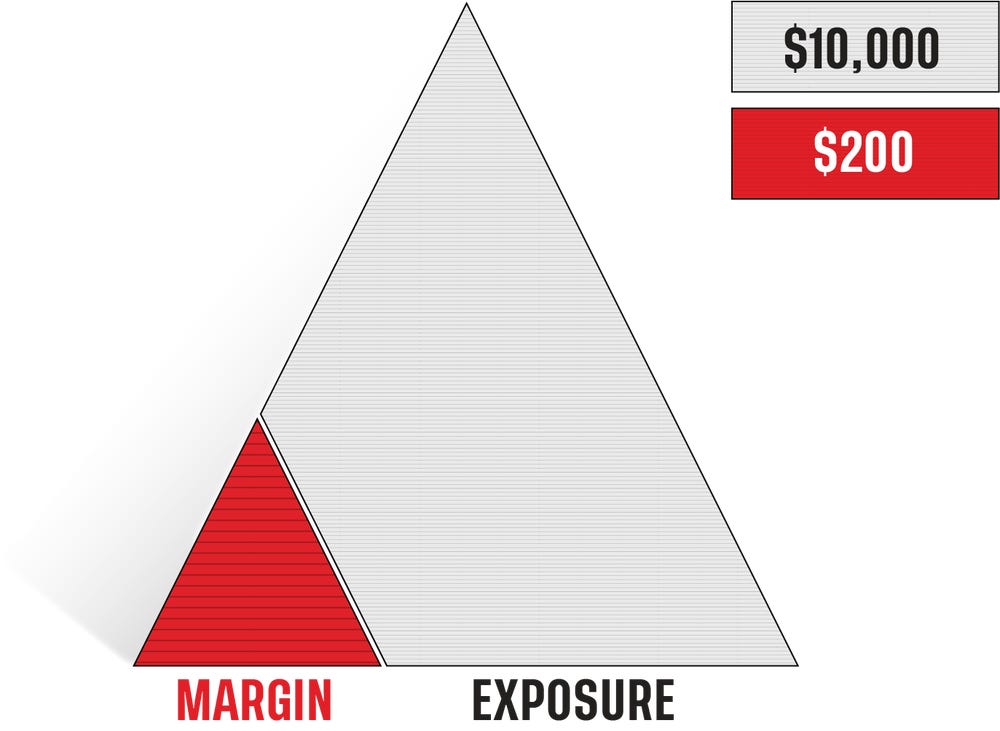

What is margin in forex and how does it work?

Forex markets are leveraged, meaning you pay a fraction of the position’s total value to open the trade. This opening amount is called margin. Since your profits and losses on forex positions are calculated on the full position size, you can lose or gain more than the amount you paid at the position’s opening.

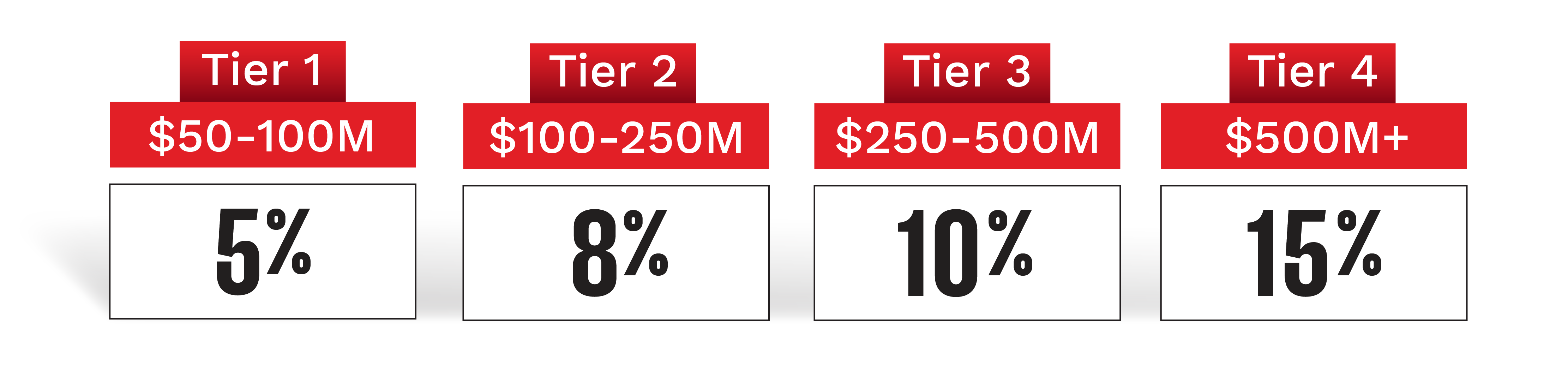

Forex Volume Based Rebates

Our most active traders get even lower costs, including cashback forex rebates up to 15% on our already-competitive spreads. Find out if your forex trading would qualify for volume-based rebates.

Ready to join the #1 forex broker in the US2?

- Trade 80+ currency pairs

- Enjoy the best spreads in the US3

- 24/5 access to forex markets and real trading support

Ready to join the #1 forex broker in the US2?

- Trade 80+ currency pairs

- Enjoy the best spreads in the US3

- 24/5 access to forex markets and real trading support

FREQUENTLY ASKED QUESTIONS

No, the only cost to enter a forex trade is the bid-ask spread. However, holding positions overnight can be subject to overnight funding charges. Learn more about overnight funding here.

SPREADS

Our forex spreads vary depending on underlying market liquidity. The more liquid the market, the narrower our spread – as low as 0.8 pips. As the underlying market spread widens, so can ours.

FOREX OVERNIGHT CHARGES

The overnight funding fee is calculated using the tom-next rate. These rates change daily, varying the funding fee each day. Mini and micro forex contracts are subject to a higher funding rate. Find more info on costs and charges here.

Tom-next is the rate used to calculate the funding adjustment when a forex position is held overnight. It is an industry-standard rate, derived from the interest rate differentials of the pair’s currencies and market expectations of interest rate change. Find more info on costs and charges here.

2 #1 Overall Broker, #1 Mobile App, #1 Trust Score, #1 Education, #1 Web Platform are accolades presented to IG, parent company of tastyfx, on January 28, 2025, during the ForexBrokers.com 2025 Annual Awards. Accolades were awarded by the ForexBrokers.com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Click here to learn about how they rate brokers.

3 Best for Low Spread Trading and Best Forex Spreads in the US are accolades presented to tastyfx by FXEmpire.