Factors that affect the forex market

Factors that move the forex market

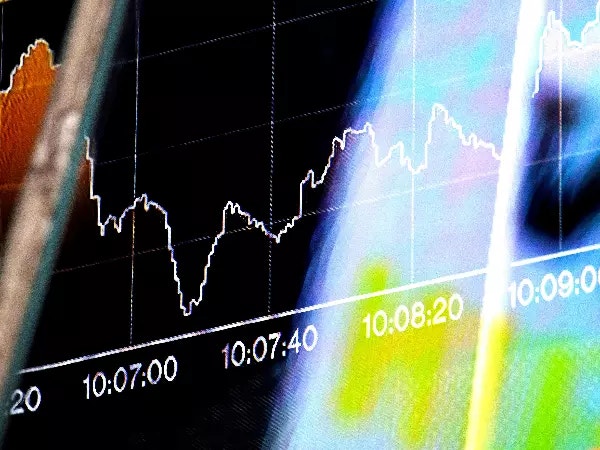

Forex trading can be extremely volatile, and a variety of factors can influence a currency pair's price. The factors that generally have the greatest impact on price action derive from relative economic performance in each country or region. These "external factors" are numerous and their impact can vary - from higher interest rates creating demand to geopolitical uncertainty destabilizing prices. Traders should also consider how they encounter forex markets, or "internal factors," that impact trading strategies and decision making.

Internal Factors | External Factors |

Trader's knowledge of the market | Global market news |

Global currency insight | Geopolitical conflict |

Financial literacy | Economic data |

Forex broker | Interest rate environment |

Internal factors that affect forex trading strategies

Internal factors are components affecting forex strategy that are specific to the trader’s experience level and can be in their control. Internal factors affecting the forex market include:

- A trader’s knowledge of the market can better prepare you for large market movements. Learning not only the basics like how pairs move and how to place a trade but also more in-depth contexts such as how forex pairs are priced and when is a good time to trade can help new forex traders get started.

- Global currency insight can be gained by following news related to global markets and exploring the historical price action of major forex pairs over the different time zones of the last day as well as weeks, months, and years in the past.

- Financial literacy is essential in any asset class, and in forex markets it can mean understanding leverage as well as economic trends that use charts and technical or fundamental analysis.

- Forex brokers can range in the benefits that they supply traders. Many traders assess platform technology, customer service, and trading costs when choosing a broker as these items might affect an individual’s trading.

External factors that move the forex market

External factors can affect forex market movement while usually being out of the trader’s control. However, an awareness of the following factors can help in managing risk and preparing for the next opportunity:

- Global market news can be relevant to the volatility in the forex market. Ongoing events such as stock market crashes or supply-chain issues can shift the relationship between two regions as well as their exchange rate.

- Geopolitical conflict can result in war that has many effects on a country’s economy, which then might move their currency in the forex market.

- Economic data can have a large influence over where forex markets trade in the short term around the release and also trend in the long term. For example, employment data can promote strength or weakness for its coinciding currency, which can be a source of opportunity for traders looking to utilize market volatility.

- Interest rate environments are often compared between regions resulting in corresponding price action. For example, higher interest rates in the US relative to those in the UK can conclude in dollars outperforming pounds, and vice versa.

Ready to start trading? Open a live or demo account today

What currencies are available in the global forex market

There are over 80 currency pairs available to trade in the tastyfx forex market. Some are more popular than others, but all can provide great opportunities for traders. Forex pairs categories include major, minor, Australasian, Scandinavian, and Exotic markets. Currencies are represented by a three-letter code which tend to start with the currency region in two letters and one for the currency itself. For example, “GBP” is Great British Pounds.

Major forex pairs

Some of the most popular pairs in the forex market are the major pairs that tend to trade in high volumes, represent large economies, and can incur large amounts of market news. The major pairs are as follows:

- GBP/USD – British pound vs US dollar

- EUR/USD – euro vs US dollar

- EUR/GBP – euro vs British pound

- USD/JPY – US dollar vs Japanese yen

- AUD/USD – Australian dollar vs US dollar

- USD/CAD – US dollar vs Canadian dollar

- EUR/JPY – euro vs Japanese yen

- USD/CHF – US dollar vs Swiss franc

- GBP/EUR – British pound vs euro

Minor pairs

Minor currency pairs are often traded less frequently than major pairs but can move with greater volatility. The minor pairs are as follows below:

- GBP/CHF – British pound vs Swiss franc

- GBP/JPY – British pound vs Japanese yen

- EUR/CAD – euro vs Canadian dollar

- GBP/CAD – British pound vs Canadian dollar

- CAD/JPY – Canadian dollar vs Japanese yen

- CHF/JPY – Swiss franc vs Japanese yen

- CAD/CHF – Canadian dollar vs Swiss franc

- USD/ZAR – US dollar vs South African Rand

- USD/SGD – US dollar vs Singapore dollar

- GBP/SGD – British pound vs Singapore dollar

- SGD/JPY – Singapore dollar vs Japanese yen

- GBP/ZAR – British pound vs South African rand

- EUR/SGD – euro vs Singapore dollar

- USD/HKD – US dollar vs Hong Kong dollar

- EUR/ZAR – euro vs South African rand

- ZAR/JPY – South African rand vs Japanese yen

Regional pairs

The regional pairs are currency pairs that relate to specific regions in global forex. The Australasian and Scandinavian are the common regional pairs markets, and they are as follows:

Australasian pairs

- EUR/NZD – euro vs New Zealand dollar

- GBP/AUD – British pound vs Australian dollar

- EUR/AUD – euro vs Australian dollar

- AUD/NZD – Australian dollar vs New Zealand dollar

- GBP/NZD – British pound vs New Zealand dollar

- NZD/JPY – New Zealand Dollar vs Japanese yen

- AUD/JPY – Australian dollar vs Japanese yen

- AUD/CAD – Australian dollar vs Canadian dollar

- AUD/CHF – Australian dollar vs Swiss franc

- NZD/CAD – New Zealand dollar vs Canadian dollar

- AUD/SGD – Australian dollar vs Singapore dollar

- NZD/CHF – New Zealand dollar vs Swiss franc

- NZD/USD – New Zealand dollar vs US dollar

Scandinavian pairs

- EUR/NOK – euro vs Norwegian krone

- USD/NOK – US dollar vs Norwegian krone

- GBP/SEK – British pound vs Swedish krona

- USD/SEK – US dollar vs Swedish krona

- GBP/NOK – British pound vs Norwegian krone

- EUR/SEK – euro vs Swedish krona

- CHF/NOK – Swiss franc vs Norwegian krone

- NOK/JPY - Norwegian krone vs Japanese yen

- CAD/NOK – Canadian dollar vs Norwegian krone

- GBP/DKK – British pound vs Danish krone

- EUR/DKK – euro vs Danish krone

- NOK/SEK - Norwegian krone vs Swedish krona

- USD/DKK – US dollar vs Danish krone

- SEK/JPY – Swedish krona vs Japanese yen

Exotic pairs

Exotic pairs include major currencies against currencies from smaller economies. These currency pairs are typically the least traded pairs in the market. They are as follows:

- USD/HUF – US dollar vs Hungarian forint

- USD/MXN – US dollar vs Mexican peso

- USD/TRY – US dollar vs Turkish lira

- EUR/MXN – euro vs Mexican peso

- EUR/TRY – euro vs Turkish lira

- PLN/JPY – Polish zloty vs Japanese yen

- EUR/CZK – euro vs Czech koruna

- USD/CZK – US dollar vs Czech koruna

- USD/PLN – Us dollar vs Polish zloty

- GBP/TRY – British pound vs Turkish lira

- EUR/ILS – euro vs Israeli shekel

- GBP/PLN – British pound vs Polish zloty

- GBP/HUF – British pound vs Hungarian forint

- GBP/ILS – British pound vs Israeli shekel

- GBP/MXN – British pound vs Mexican peso

- GBP/CZK – British pound vs Czech koruna

- EUR/HUF – euro vs Hungarian forint

- MXN/JPY – Mexican peso vs Japanese yen

- TRY/JPY – Turkish lira vs Japanese yen

Emerging markets forex pairs

Emerging markets forex pairs can include currencies of emerging economies, but they are often based on the Chinese yuan (CNH). Emerging markets pairs are as follows:

- AUD/CNH – Australian dollar vs Chinese yuan

- USD/CNH – US dollar vs Chinese yuan

- EUR/CNH – euro vs Chinese yuan

- GBP/CNH – British pound vs Chinese yuan

- NZD/CNH – New Zealand dollar vs Chinese yuan

- CAD/CNH – Canadian dollar vs Chinese yuan

- CNH/JPY – Chinese yuan vs Japanese yen

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.