Fed Meeting: When is it and what will happen?

Will the Fed raise interest rates?

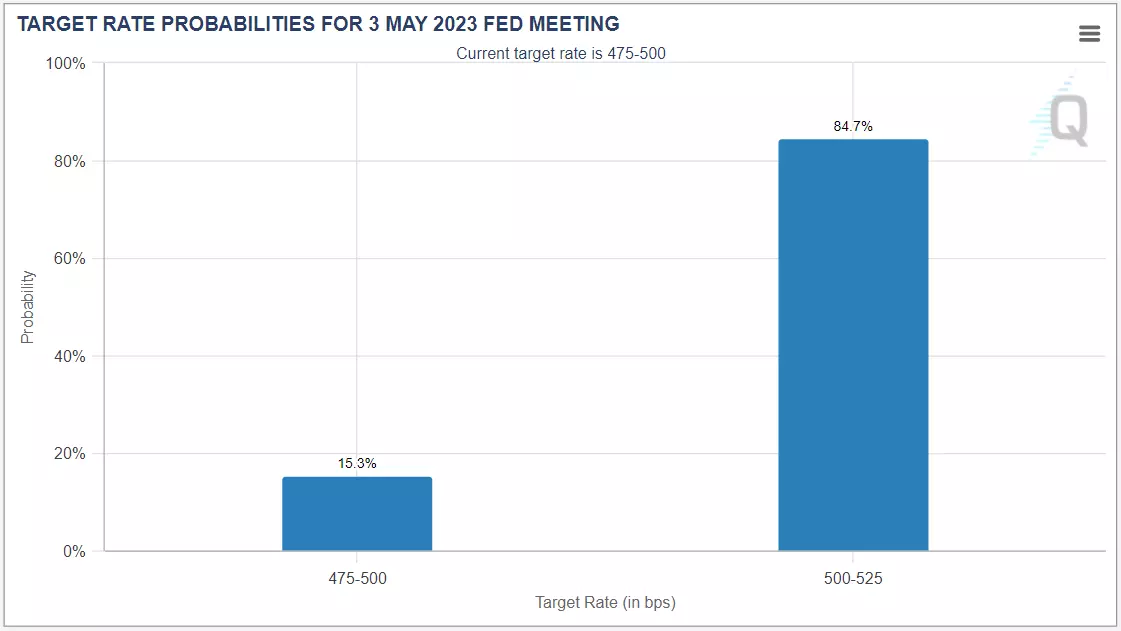

The probability of the Fed raising rates 0.25%, or 25 basis points (bps), is 84.7% the day before the meeting, according to data taken from CME Group's FedWatch Tool at 5pm ET. Though the likelihood of an interest rate hike from the Fed is greater than not, the FOMC will decide whether or not to raise rates relative to how they view the economy outside of what the market projects.

The Fed tends to monitor inflation and employment as leading indicators for what they will do to interest rates, and the recent decline in inflation has traders wondering if this might be the last interest rate hike or if they will even hike at all. The regional banking crisis in the US has caused many to call for an end to more interest rate hikes that could further the problem.

How will the Fed meeting affect forex?

Forex markets can be highly correlated to interest rate markets as higher interest rates in a region tends to result in greater demand for that region's currency; traders can employ the carry trade - buying currencies with higher interest rates while selling those with lower rates - in an attempt to profit from the interest payment for holding a position with 'positive carry' overnight. However, there is risk in the forex position moving against the trader by an amount exceeding the interest payment, which would result in a loss.

How to trade Fed meetings with forex

- Choose the forex market you’d like to trade

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions

You can trade forex markets like EUR/USD around the Fed meeting with an account from tastyfx, however, it should be noted that such events can result in increased volatility. Most strategies applicable to trading in other markets can be used to trade forex as well, including technical and fundamental analysis.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.