Forex Market Sentiment: Tide Turns on USD

Sentiment has edged in the direction of long US dollar or held unchanged across every major pair over the course of the last week; furthermore, USD/JPY client sentiment has flipped from short to long. The US dollar gaining sentiment in the same time that it has depreciated against most major currency partners does not appear to be a coincidence; for example, USD/JPY went from 53% short to 51% long amid a decline of 1.6% in the pair all in the last week of trading.

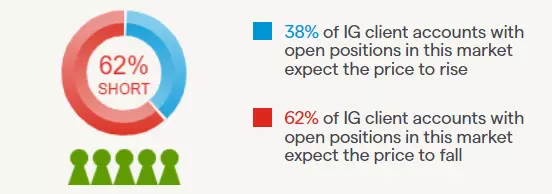

Client Sentiment shows the percentage of tastyfx client accounts with open positions that are currently long or short. If the majority of client accounts with open positions are long a given market, then they expect the price to rise; if the majority is short, then they expect it to fall. (Values taken using tastyfx's Client Sentiment measure as of the previous day's close.)

EUR/USD - 60% Long

Last week's sentiment: 60% Long

The Eurozone and US seem to be grouped together as traders try to suss out what parts of the global economy the recent banking crisis might affect, given that EUR/USD has not moved much in either price or client sentiment. Only time will tell whose economy is more hindered by this developing event.

GBP/USD - 60% Long

Last week's sentiment: 61% Long

GBP and EUR cycle through high and low correlations, and it looks like the two currencies are currently exhibiting the former relative to USD. British pound longs diminished slightly amid moderate strength in GBP/USD; the pair now stands firmly between 1.20 and 1.25.

USD/JPY - 51% Long

Last week's sentiment: 53% Short

Is USD/JPY the first of many major pairs to turn from short USD to long? Or is this just a blip on the radar that's been overwhelmingly short dollars in recent weeks? The market appears to be using Japanese yen as a flight-to-quality instrument whenever a new dose of fear is injected, which has brought USD/JPY near year-to-date lows.

AUD/USD - 67% Long

Last week's sentiment: 69% Long

Australian dollars are showing the most long sentiment of any major pair against USD. Even after losing 2%, AUD/USD client sentiment is coming in at a whopping 2/3rds of the tastyfx audience. The pair has been relatively content trading below 0.70, but growing fear in the US could challenge that.

USD/CAD - 62% Short

Last week's sentiment: 70% Short

Canadian dollars lost a substantial amount of their long sentiment (short USD/CAD translates to long CAD) as they continue to trade near year-to-date lows. USD/CAD is still holding in above 1.36, and the pair's high is just north of 1.38 going all the way back to 2020.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.