How inflation could help the US dollar

Historical correlation

June's US core inflation data will be released this week, with an expected rate of 5.0%. When looking back across the past year, this rate would be the lowest in a continued downward trend from a high in October 2022*. The chart of EUR/USD below illustrates the correlation between US inflation rates and US dollar appreciation - with year-long lows of under 0.9600 for the pair and a high of 6.6% core inflation occurring simultaneously.

EUR/USD historical prices and corresponding US core inflation

Currency demand and relative inflation

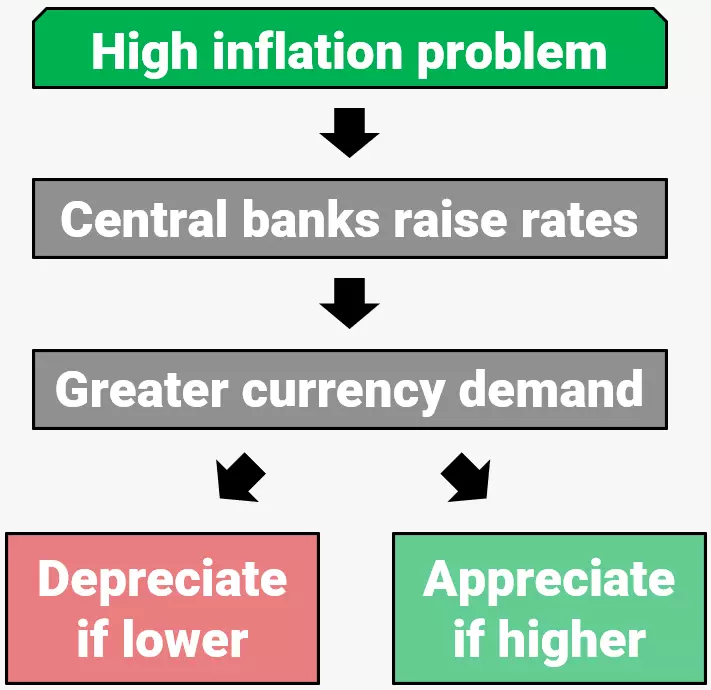

In times of high inflation, central banks are forced to raise interest rates to keep inflation down. Higher interest rates can in turn create greater demand for the currency among traders who benefit from earning the interest.

However, since forex markets are traded in pairs, prices are often contingent on the rates of both currencies. For example, in the EUR/USD example above, US inflation has stayed at a high level. Over the same time period, Eurozone inflation has been rising and even eclipsed the US in the most recent month. This inversion of relative inflation among the pair could be the reason for continued strength in the euro; more generally, the difference in relative interest rates could point to whether a currency appreciates or depreciates.

How to trade EUR/USD

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on EUR/USD

Trading forex requires an account with a forex provider like tastyfx. EUR/USD can be found in tastyfx's platform under the 'Major' pairs tab. Many traders also watch major forex pairs like GBP/USD and AUD/USD for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

*Source: tradingeconomics.com

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.