Israeli shekel: what you need to know

Key points

- War in Israel over the weekend caused USD/ILS to jump over 1,000 pips from Friday close to Sunday open

- USD/ILS hit a 7-year high above 3.9600 Sunday

- Prices stabilized after the Bank of Israel intervened

Shekel lowers amid conflict and fear

The outbreak of war in Israel over the weekend sent a shock into the nation's currency, the shekel. Upon market open Sunday night, USD, GBP and EUR gapped up over 1,000 pips against ILS resulting in multi-year extremes. USD/ILS closed Sunday above 3.9600 to mark the highest price since February 2016.

How will war in Israel affect the US?

Contingent on the US' involvement, the economic effects of war felt by the US could be minimal. Exports constitute 10.9% of US GDP and of that, only 3.5% are exports to the Middle East. Impact could vary greatly if the US decides to allocate resources to the war or if additional nations get involved.

European countries will likely see a greater impact due to geographic proximity and the EU's history of financial aid to Palestine. As events unfold, GBP/ILS and EUR/ILS could see greater volatility as a result. Both pairs closed higher Monday while USD/ILS did not.

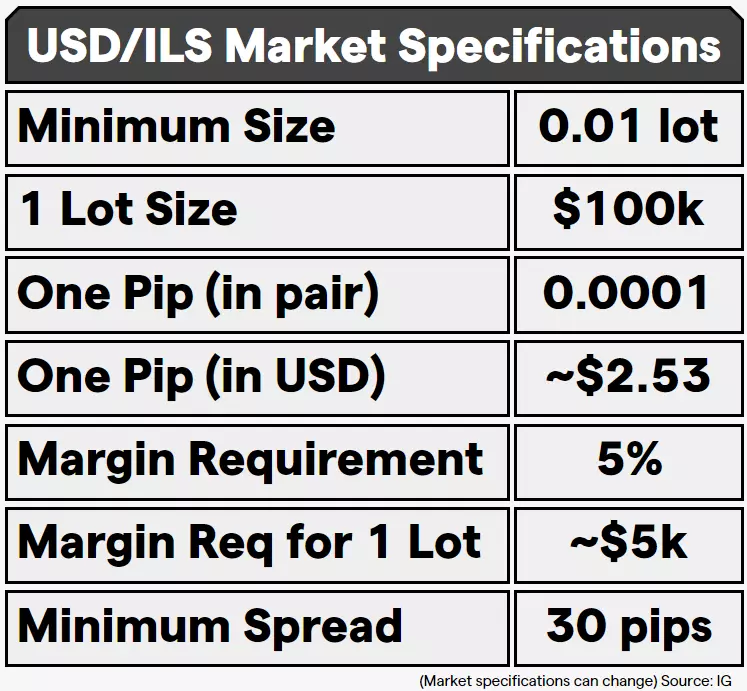

USD/ILS specifications

How to trade Israeli shekel

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on ILS pairs

Trading forex requires an account with a forex provider like tastyfx. ILS pairs can be found in tastyfx's platform under the 'Exotic' pairs tab. Many traders also watch major forex pairs like GBP/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

What is Israel's currency?

Israel's national currency is the Israeli shekel. The Bank of Israel, the nation's central bank, is responsible for monetary policy and maintaining stability in financial systems.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.