Leading and lagging indicators: what you need to know

What is a leading technical indicator?

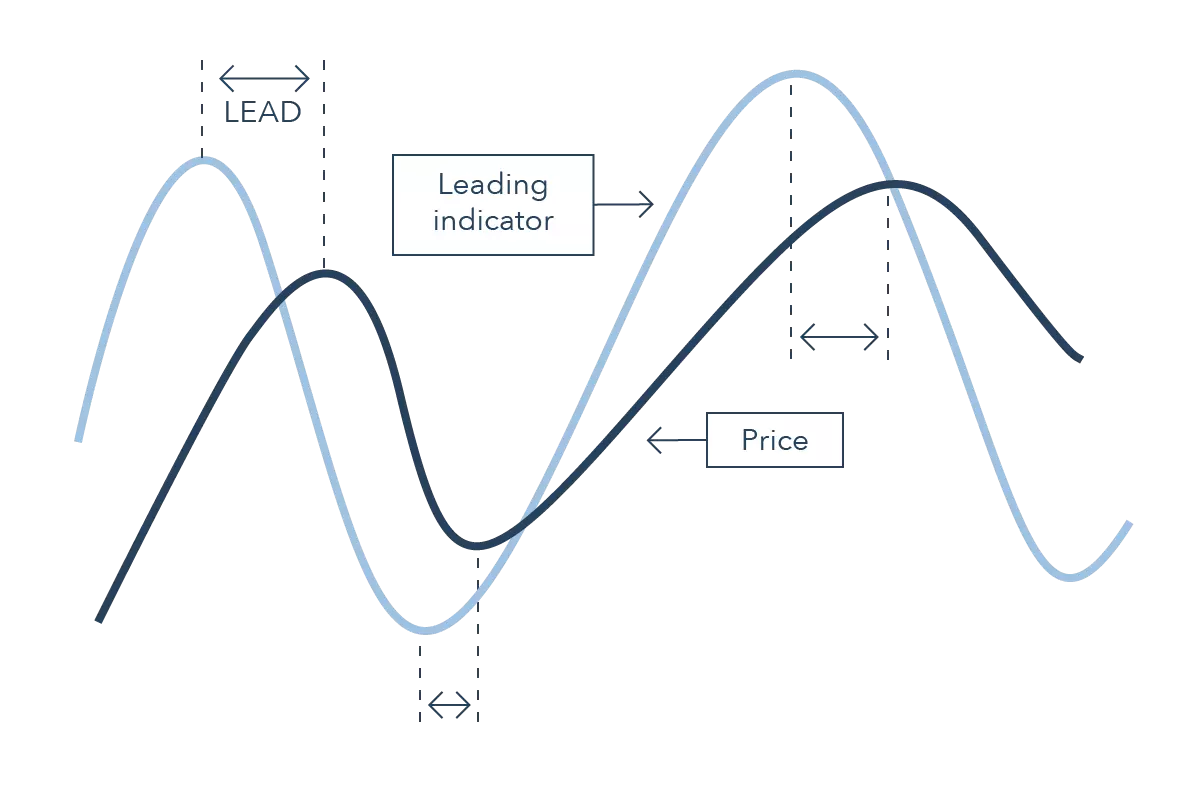

A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time.

What is a lagging technical indicator?

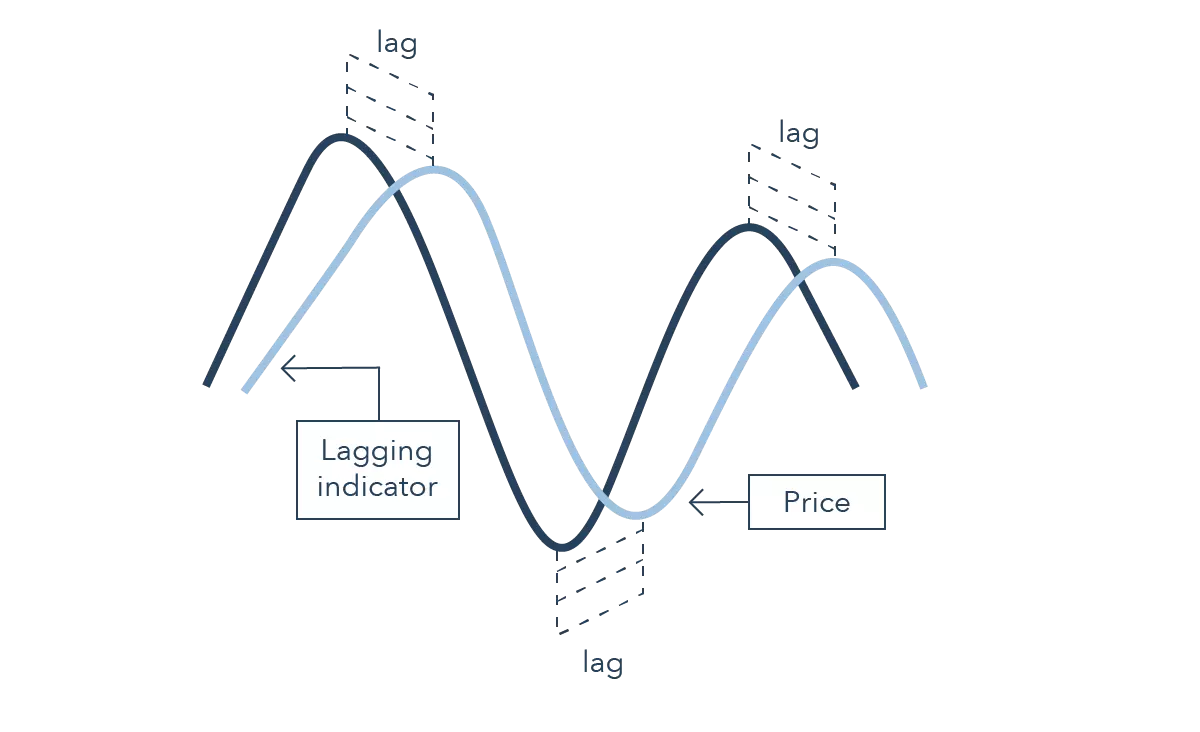

A lagging indicator is a tool that provides delayed feedback, which means it gives a signal once the price movement has already passed or is in progress. These are used by traders to confirm the price trend before they enter a trade.

These indicators are commonly used by trend traders – they don’t show any upcoming price moves but confirm that a trend is underway. This tends to give traders more confidence that they are correct in their assumptions, rather than providing a specific trigger for entering the market.

Leading vs lagging technical indicators: what’s the difference?

The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. Both leading and lagging indicators have their own advantages and drawbacks, so it’s crucial to familiarize yourself with how each works and decide which fits in with your strategy.

Leading indicators react to prices quickly, which can be great for short-term traders, but makes them prone to giving out false signals – these happen when a signal indicates it’s time to enter the market, but the trend promptly reverses. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market.

Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two.

To start using leading and lagging indicators, you can:

- Open an account. Use these technical indicators on live markets by opening an account with tastyfx

- Practice on a demo. Learn to use leading and lagging indicators in a risk-free environment with a tastyfx demo account

- Learn more about technical analysis with our curated strategy articles

Four popular leading indicators

Popular leading indicators include:

A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals.

Relative strength index (RSI)

The relative strength index (RSI) is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. When the RSI gives a signal, it is believed that the market will reverse – this provides a leading sign that a trader should enter or exit a position.

The RSI is an oscillator, so it is shown on a scale from zero to 100. If the RSI is above 70, the market would often be thought of as overbought and appear as red on the chart. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart.

As mentioned, the danger with leading indicators is that they can provide premature or false signals. With the RSI, it is possible that the market will sustain overbought or oversold conditions for long periods of time, without reversing. This makes it important to have suitable risk management measures in place, such as stops and limits.

Stochastic oscillator

Another popular example of a leading indicator is the stochastic oscillator, which is used to compare recent closing prices to the previous trading range.

The stochastic is based on the idea that market momentum changes direction much faster than volume or price, so it can be used to predict the direction of market movements. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold.

The oscillator is shown as two lines on the chart, the %K (the black line on the chart below) and the %D (the red dotted line below). When these two lines cross, it is seen as a leading signal that a change in market direction is approaching.

During volatile market conditions, the stochastic is prone to false signals. To prevent this impacting your trades, you could use the stochastic in conjunction with other indicators or use it as a filter for your trades rather than a trigger. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator.

Williams %R

The Williams percent range, more commonly known as the Williams %R, is very similar to the stochastic oscillator. The main difference being that it works on a negative scale – so it ranges between zero and -100, and uses -20 and -80 as the overbought and oversold signals respectively.

The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. As the Williams %R is leading, these signals can be premature and less reliable than other entry signals, which is why some traders prefer to use -10 and -90 as more extreme price signals.

On-balance volume (OBV)

On-balance volume (OBV) is another leading momentum-based indicator. It looks at volume to enable traders to make predictions about the market price – OBV is largely used in shares trading, as volume is well documented by stock exchanges.

Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. This is believed to be an indication that the price will increase or decrease imminently.

As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. Although volume changes, this is not always indicative of a trend and can cause traders to open positions prematurely.

As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy.

Three popular lagging indicators

Popular lagging indicators include:

Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows.

Moving averages

Moving averages (MAs) are categorized as a lagging indicator because they are based on historical data.

Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each other. However, because the moving average is calculated using previous price points, the current market price will be ahead of the MA.

In the below 50-day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent. However, we can see that the MA is slower to pick up the bullish trend when it does occur.

Moving averages can be calculated over any timeframe, depending on the trader’s goals – but the longer the time frame, the longer the lag. So, a MA of 300 days would have a far longer delay than an MA of 50 days.

It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react.

MACD indicator

Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence (MACD). As it is based on MAs, the MACD is inherently a trend-following or lagging indicator. However, it has been argued that different components of the MACD provide traders with different opportunities.

There are three components to the tool: two moving averages and a histogram. The two moving averages (the signal line and the MACD line) are invariably lagging indicators, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion.

But the MACD histogram is sometimes considered a leading indicator, as it is used to anticipate signal crossovers in between the two moving averages. The bars on the histogram represents the difference between the two MAs – as the bars move further away from the central zero line, it means the MAs are moving further apart. Once this expansion is over, a ‘hump’ appears on the histogram which is a sign the MAs will tighten again, and a crossover will occur.

Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. So, in general it is a lagging indicator. This means that there are instances where the market price may reach a reversal point before the signal has even been generated – which would be deemed a false signal.

Bollinger bands

The Bollinger band tool is a lagging indicator, as it is based on a 20-day simple moving average (SMA) and two outer lines. These outer bands represent the positive and negative standard deviations away from the SMA and are used as a measure of volatility. When levels of volatility increase, the bands will widen, and as volatility decreases, they will contract.

When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the market to rebound back towards the central 20-period moving average.

There are strategies that suggest the bands have leading indicator properties, but alone they do not give out leading trading signals. Bollinger bands can give no indication of exactly when the change in volatility might take place, or which direction the price will move in. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals.

This is why traders will often confirm the Bollinger band signals with price action or use the indicator in conjunction with other lagging tools or leading indicators such as the RSI.

Leading and lagging technical indicators summed up

- A leading indicator is a tool designed to anticipate the future direction of a market

- A lagging indicator is a tool that gives signal once the price movement has already started

- Leading indicators react to prices quickly but this makes them prone to giving out false signals

- Lagging indicators can be more accurate but this is because they are far slower to react

- A lot of popular leading indicators fall into the category of oscillators, including the RSI, stochastic oscillator, Williams %R and OBV

- Lagging indicators are drawn onto the price chart itself and include moving averages, the MACD and Bollinger bands

- Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two

If you feel ready to start using lagging and leading indicators on live markets, you can open an account with tastyfx today.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.