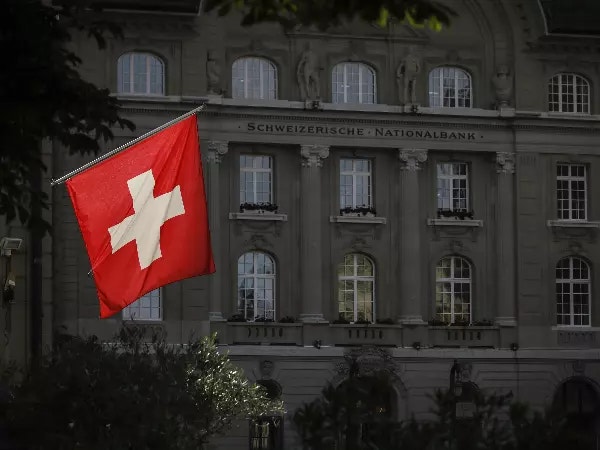

Swiss franc strengthens as gold prices near all-time highs

Data current as of 1/31/24

Key points

In the last week, USD/CHF has fallen over 100 pips to trade under 0.8600. While the pair started the year below this benchmark, historically 0.8600 is still on the low end of the trading range.

Swiss franc's correlation to gold

Interestingly, among the US dollar pairs, USD/CHF has shown the strongest correlation to gold. Therefore, movements in gold prices can be a significant indicator for those trading USD/CHF. For instance, in periods where gold prices surge, traders might anticipate a potential decline in the USD/CHF pair, as the Swiss franc's value increases relative to the US dollar.

Despite the recent decline in USD/CHF, data from tastyfx indicates that 85% of traders are taking long positions on the currency pair. This could suggest a collective belief in an upcoming reversal or a strengthening of the US dollar against the Swiss franc. Traders taking long positions might be banking on a variety of factors, including potential shifts in monetary policy, economic data releases, or geopolitical changes that could drive the US dollar up.

For those trading in the forex market, understanding the underlying factors that affect currency values is crucial. The correlation between gold and the Swiss franc is just one of many variables that can influence trading decisions. By keeping an eye on gold prices and other economic indicators, traders can better anticipate movements in the USD/CHF pair and strategize accordingly.

How to trade USD/CHF

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD/CHF

Trading forex requires an account with a forex broker like tastyfx. USD/CHF can be found in the "Major" pairs tab. Many traders watch other major forex pairs like GBP/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Our curated playlists can help you stay up to date on current markets and understanding key terms. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.