How to trade using Heikin Ashi candlesticks

What are Heikin Ashi candlesticks?

Heikin Ashi (HA) price charts are derived from conventional candlestick charts. Each HA candle will display an open high low and close value, although unlike a regular candlestick, which uses only data from the current session, the HA candle will use data from the current and previous session to derive its values.

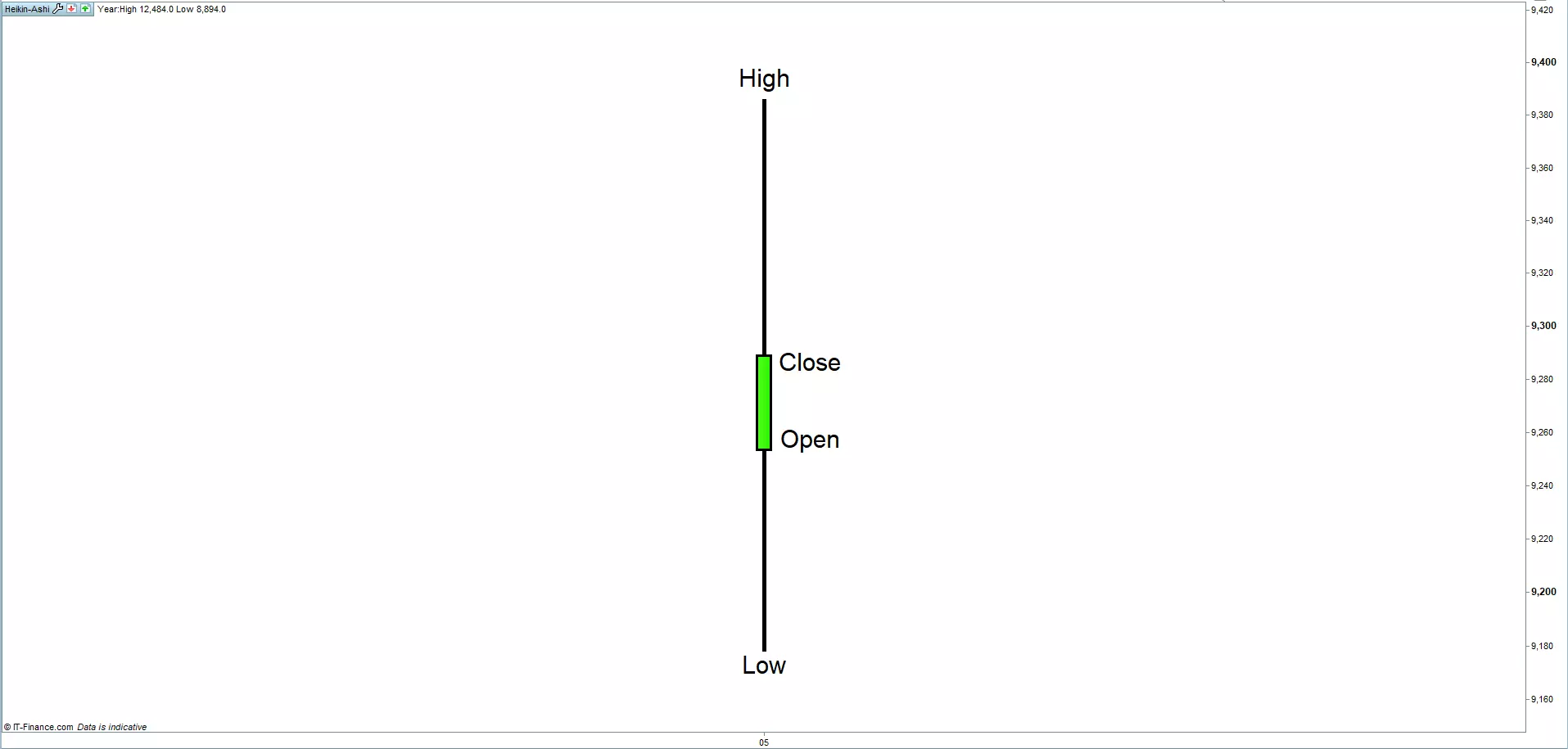

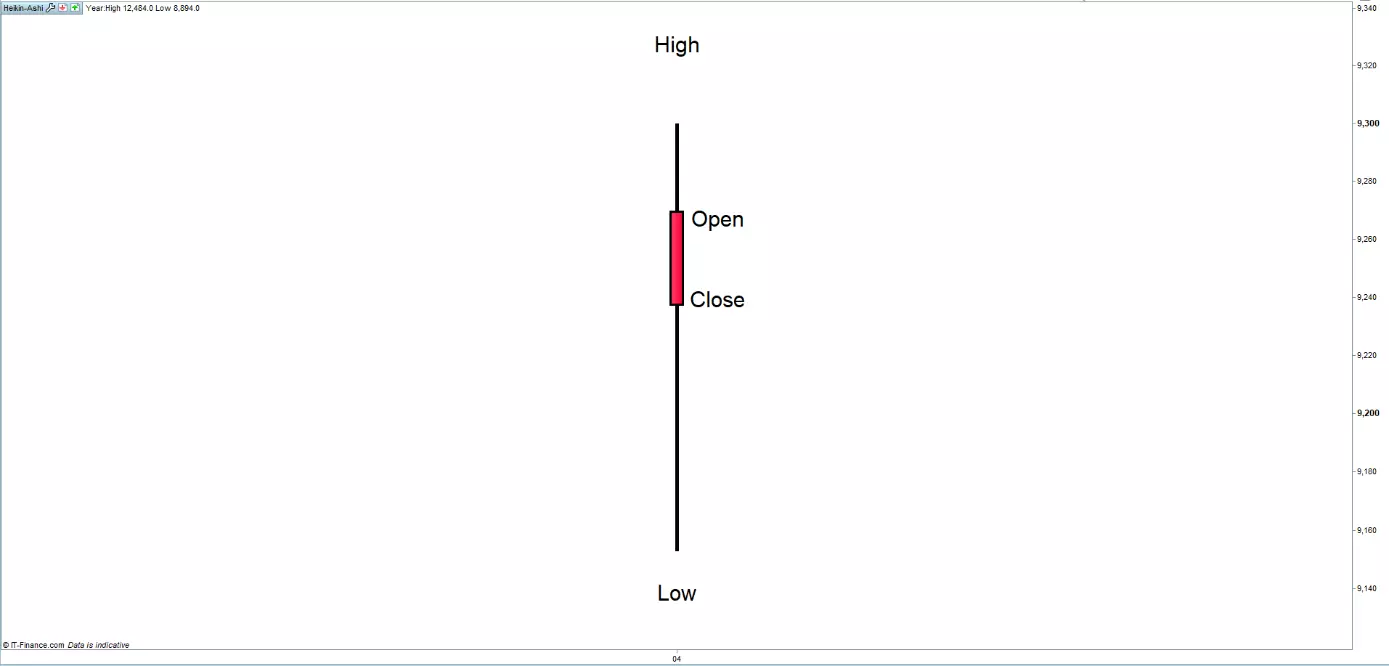

In terms of the HA candle appearance:

- The high is the highest value on the HA candle

- The low is the lowest value on the HA candle

- If the candle is green, the closing value is greater than the opening value and is represented at the top of the colored area of the HA candle

- If the candle is red, the closing value is lower than the opening value and is represented at the bottom of the colored area of the HA candle

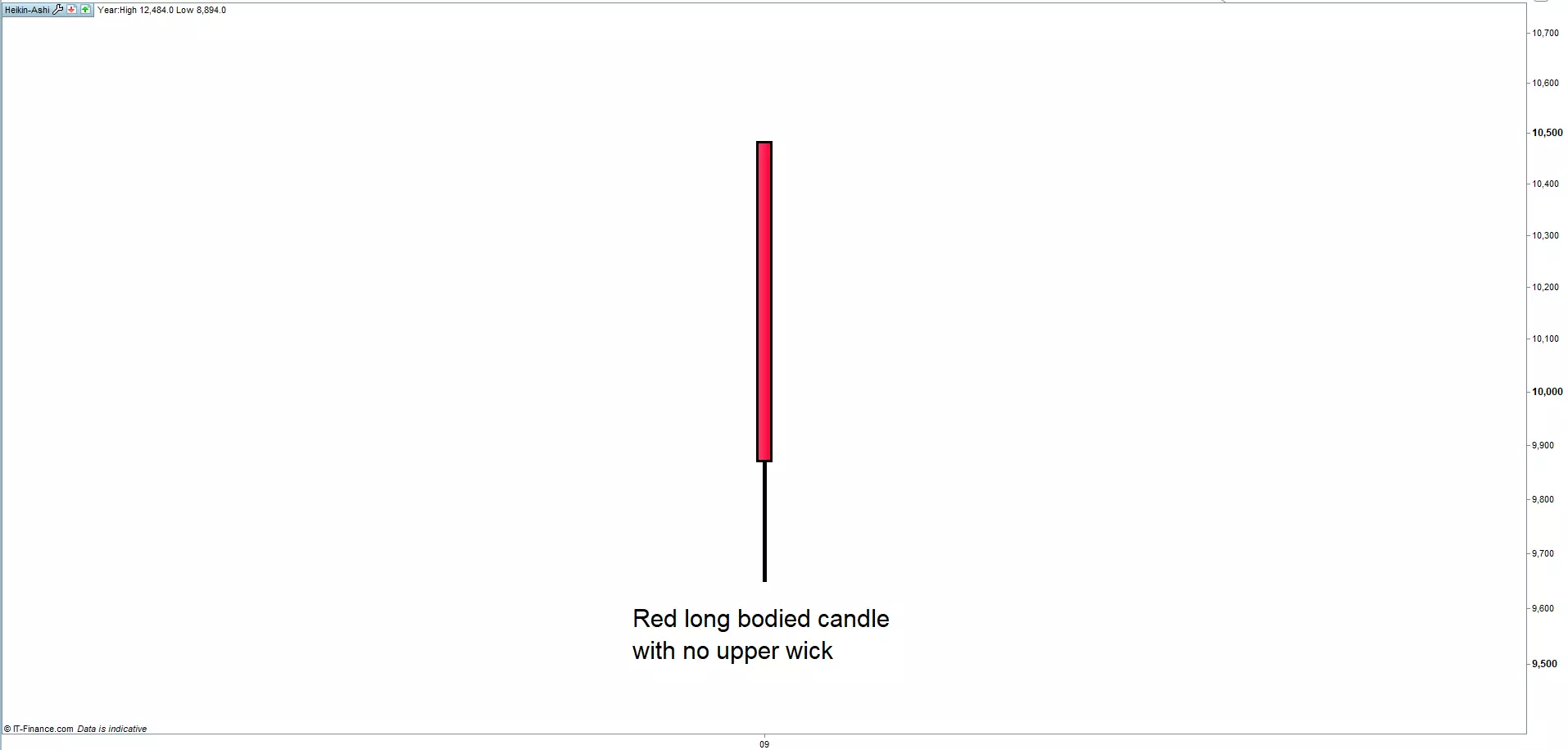

The below chart shows the anatomy of a red bodied HA candle whereby the close is lower than the open.

Trading with Heikin Ashi candlesticks

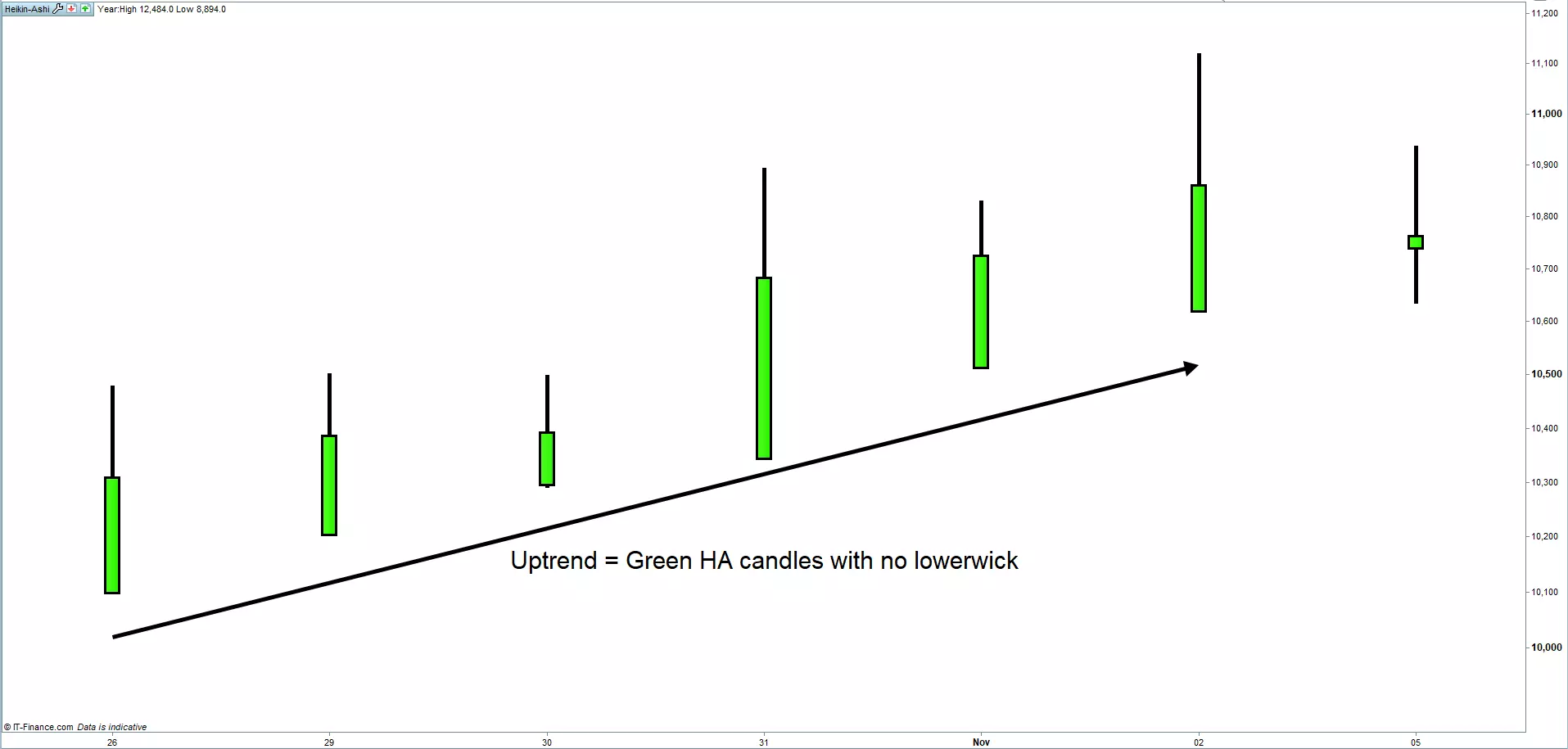

The primary use of HA candles is to indicate a directional market trend.

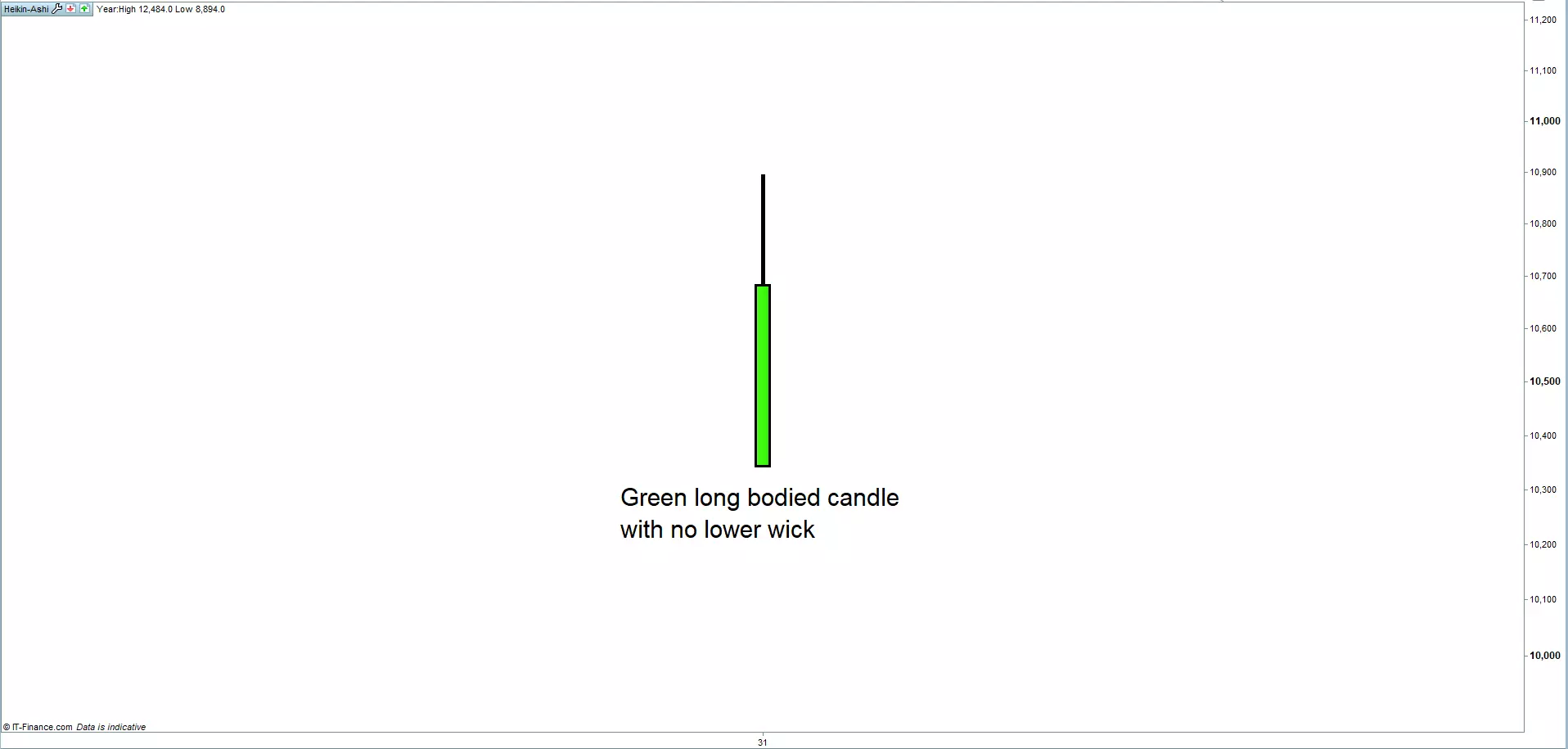

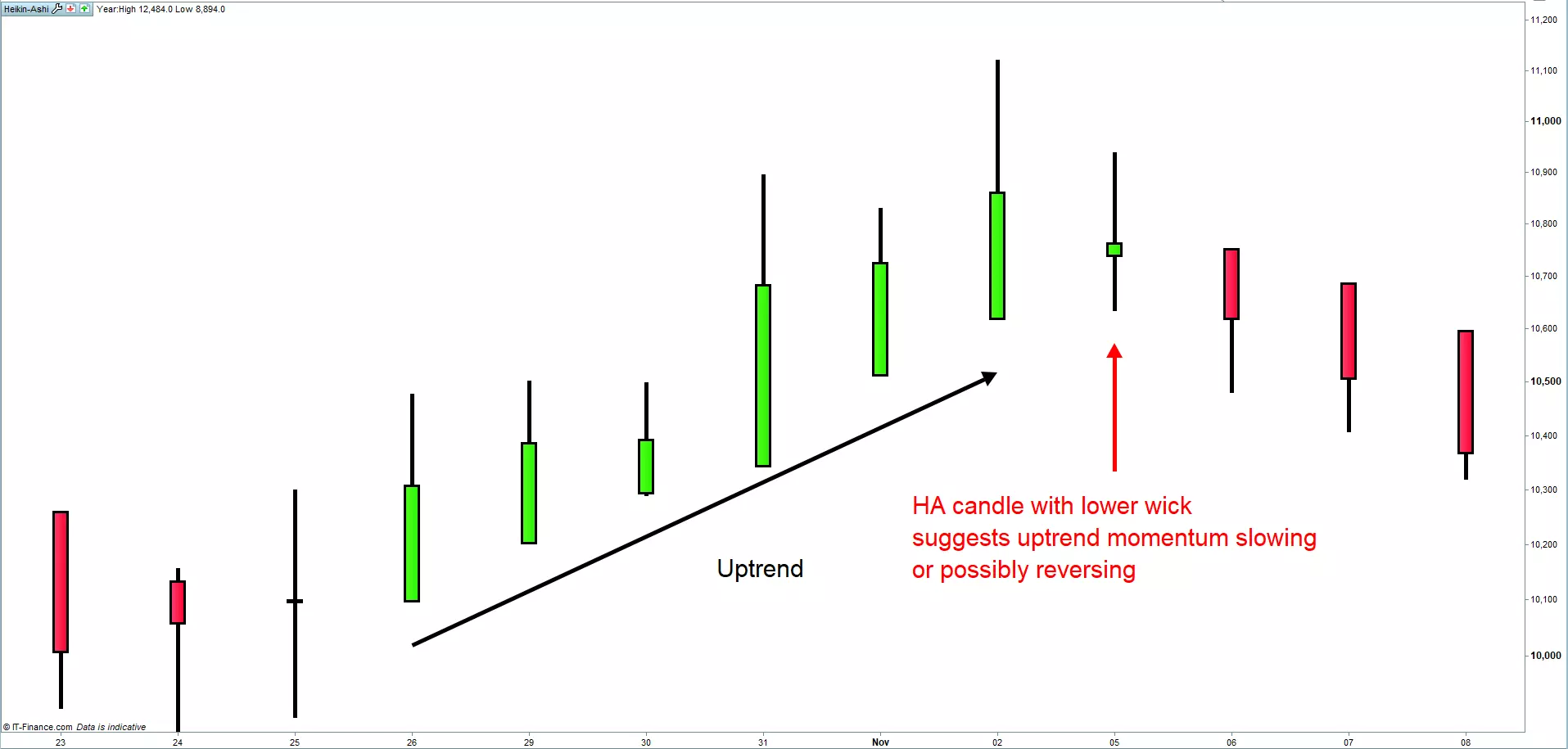

A long-bodied green HA candle with no upper wick is considered indicative of a strong upward trend.

Traders who have bought into a market might use these HA signals as indications to hold on to their positions in an attempt to maximize gains in an uptrend.

The emergence of an upper wick on an HA candle signals that an uptrend maybe losing momentum. Traders who have bought into a market might consider this as a signal to start looking to exit their respective long trades.

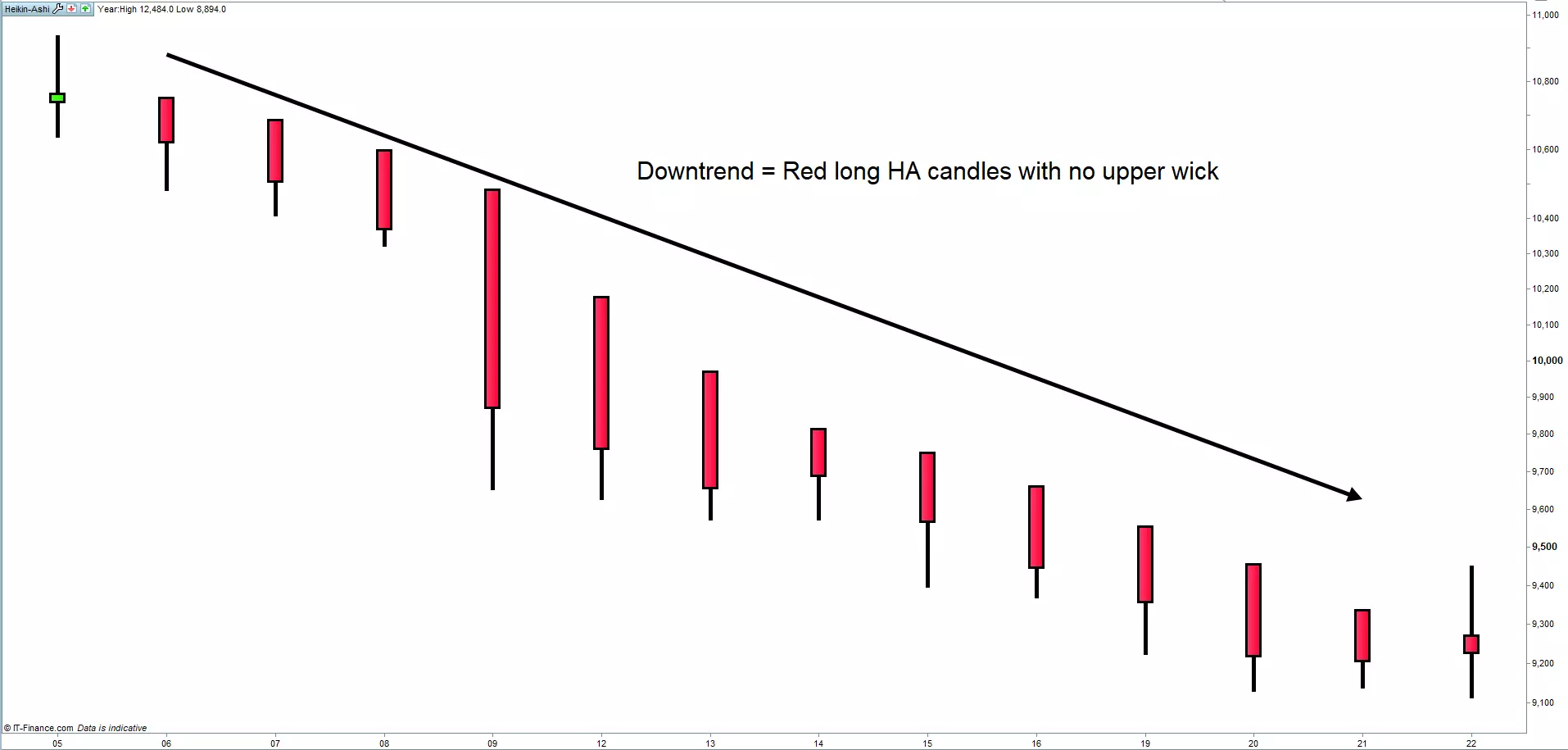

A long bodied red HA candle with no lower wick is considered indicative of a strong downward trend.

Traders who have sold short into a market might use these HA signals as indications to hold on to their positions in an attempt to maximize gains in a downtrend.

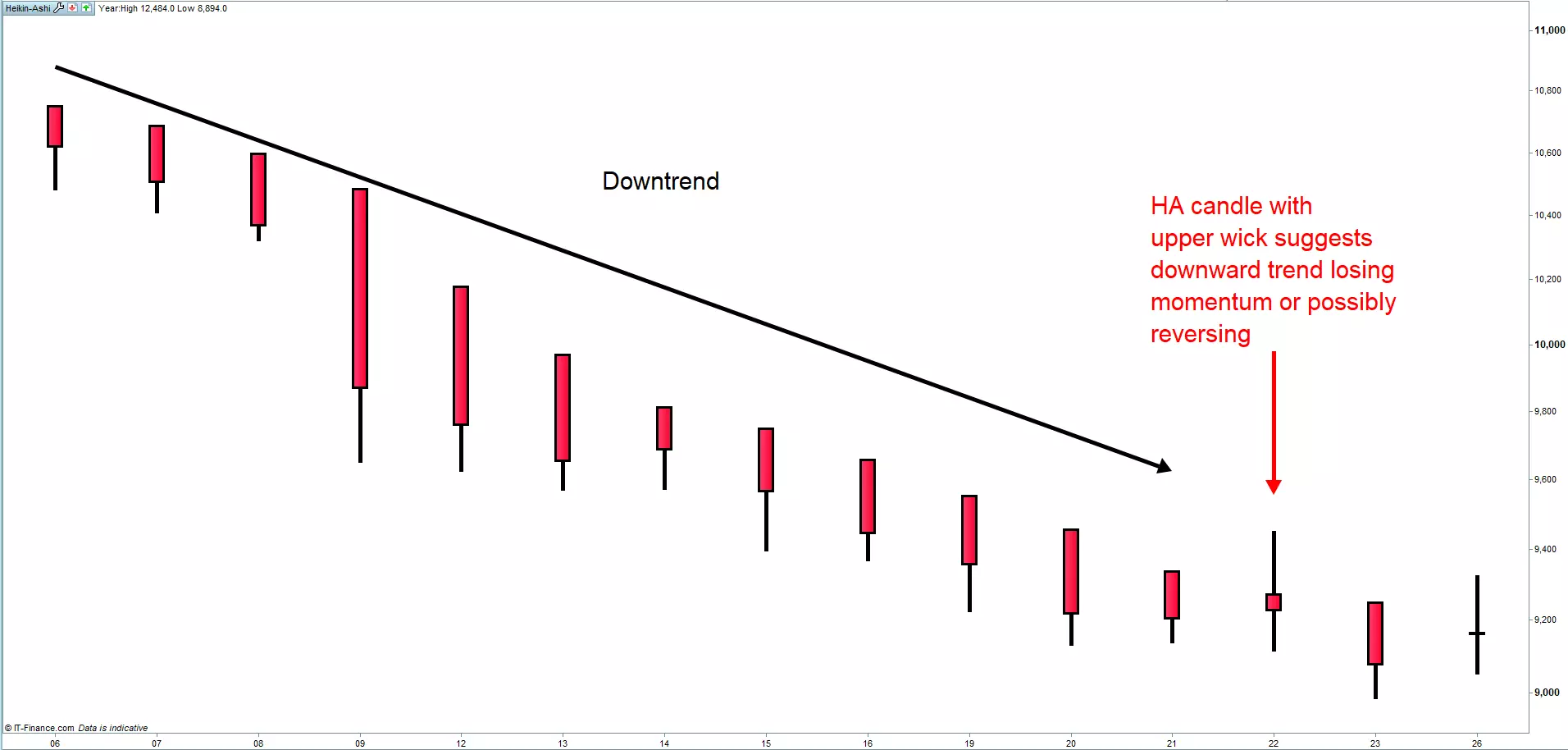

The emergence of a lower wick on the HA candle signals that a downtrend maybe losing momentum. Traders who have sold short into a market might consider this as a signal to start looking to exit their respective short trades.

In summary

- HA is an advanced form of candlestick analysis

- The HA candle shows a high, open, low and close value based on the current and previous session data points

- A wick (upper or lower) refers to the non-colored area above or below the body of a HA candle

- The body of an HA candle highlights the closing price relative to the closing price of a trading session

- A red HA candle shows the closing price to be lower than the opening price and is considered bearish

- A green HA candle shows the closing price to be higher than the opening price and is considered bullish

- HA candles are primarily used to asses the health of a price trend

- A long bodied green HA candle with no upper wick suggests a strong upward trend

- A long bodied red HA candle with no lower wick suggests a strong downward trend

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.