What is exponential moving average (EMA) and how to use it

What is exponential moving average (EMA)?

The exponential moving average (EMA) is a type of moving average that considers the weighted average of a series of recent data to reflect the ongoing trend in the market. The weight of the EMA is exponentially tilted towards more recent occurrences, giving the recent data greater influence over the reading.

This price-based indicator typically looks at the average closing price of a security over a specified number of periods, such as a 50-day, 100-day or longer 200-day EMAs, smoothing out short-term price fluctuations to provide a clearer image of the market trend.

The underlying assumption here is that price patterns tend to repeat over time and market technicians believe that humans often are irrational and emotional and thus tend to behave similarly in similar circumstances. EMA may be used by itself, but oftentimes in conjunction with other technical analysis tools or fundamental analysis for trading as well.

How to calculate exponential moving average

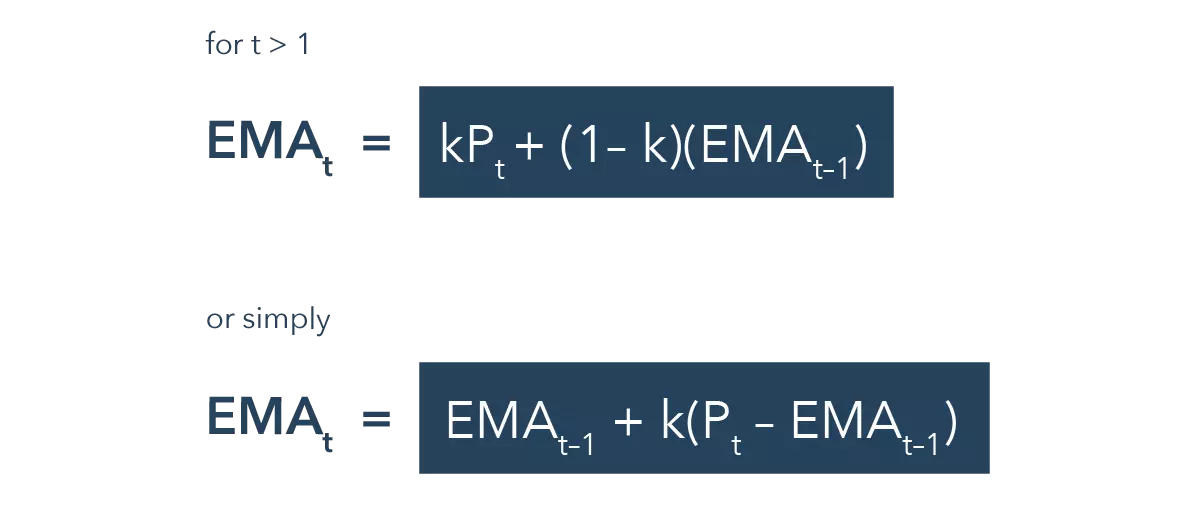

The computation of a security’s EMA is broadly straightforward. The exponential m-day moving average EMA with smoothing parameter k is defined as the below.

The smoothing parameter k takes on a value of between 0 and 1, typically chosen as 2/(m+1). An example is shown below for the computation of EMA where m = 5 and therefore k = 1/3.

| Price | EMA (m=5) | |

| Day one | 102.4 | 102.4 |

| Day two | 103.6 | 102.8 |

| Day three | 103.5 | 103.0 |

| Day four | 101.2 | 102.4 |

| Day five | 100.0 | 101.6 |

Exponential moving average vs simple moving averages

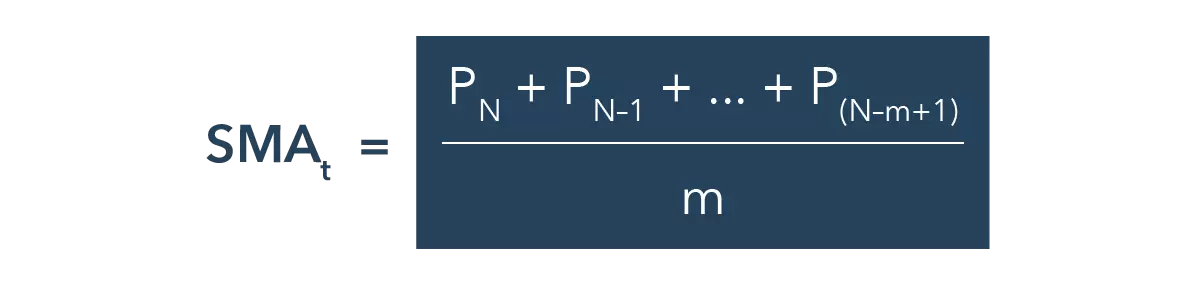

As explained above, EMA as with simple moving averages (SMAs) are popular technical analysis tools. They are also very similar in measurement of trends. SMAs can be quite simply computed using the formula below for an m-day SMA.

The difference, however, is that EMAs accord greater weightage to more recent information and will therefore be more sensitive towards the latest price changes than SMA. While this may matter very little for short-term trading, the difference becomes more apparent in the study of longer-term price trends. Recent data may be regarded as more telling of the latest market sentiment. This had also been why EMA presents itself as a popular choice of moving average between the two. In practice, both EMA and SMAs are commonly used by technical analysts and traders.

How to use exponential moving average in your trading

Both exponential and simple moving averages, while different in their computation of value, may be used in similar manners. A straightforward way to utilize moving averages in one’s trade is to use two moving averages of different time frames in conjunction.

A short-term moving average (stMA) is used to reflect the current impetus of the market while a longer-term moving average (ltMA) shows the broader trend of the market. When a stMA crosses over from underneath a ltMA, this serves as a bullish signal in the market and is commonly known as a golden cross. Conversely, the crossing over of an stMA from above a ltMA is considered bearish and is recognized as a death cross.

Exponential moving average limitations

Once again, the key trait of the EMA may also be its limitation. Given the greater influence that recent data has on the EMA, recency bias is present here. With the stock market, this can be dangerous when prices are at extremes. The EMA may fuel further buying interest in the market during a time when prices are already in extreme overbought condition, overdue for a pullback. It is important that one exercise their discretion when using any tools in their trading. Back testing would be one way to improve the validity of one’s trading strategy using tools such as the EMA. Using the EMA in conjunction with other analytical tools may also a way to improve one’s conviction in their trade.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.