How to trade using fractals

What is fractal trading?

There are two unrelated forms of fractal analysis commonly recognized by traders namely:

Fractal reversal patterns

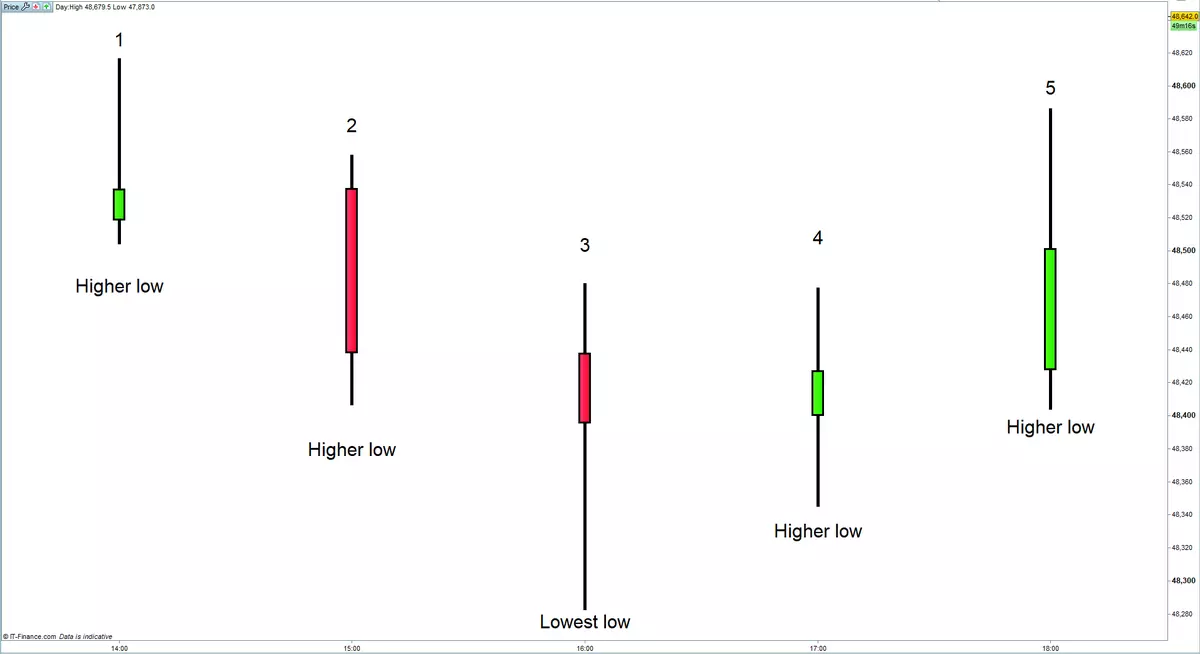

A fractal in technical analysis terms is a five bar/candle trend reversal pattern. For a bullish fractal reversal pattern:

- The third candle in a series of five would be marked as having the lowest low

- The first two candles in the pattern would have higher lows than the middle candle

- The last two candles in the pattern would have higher lows than the middle candle

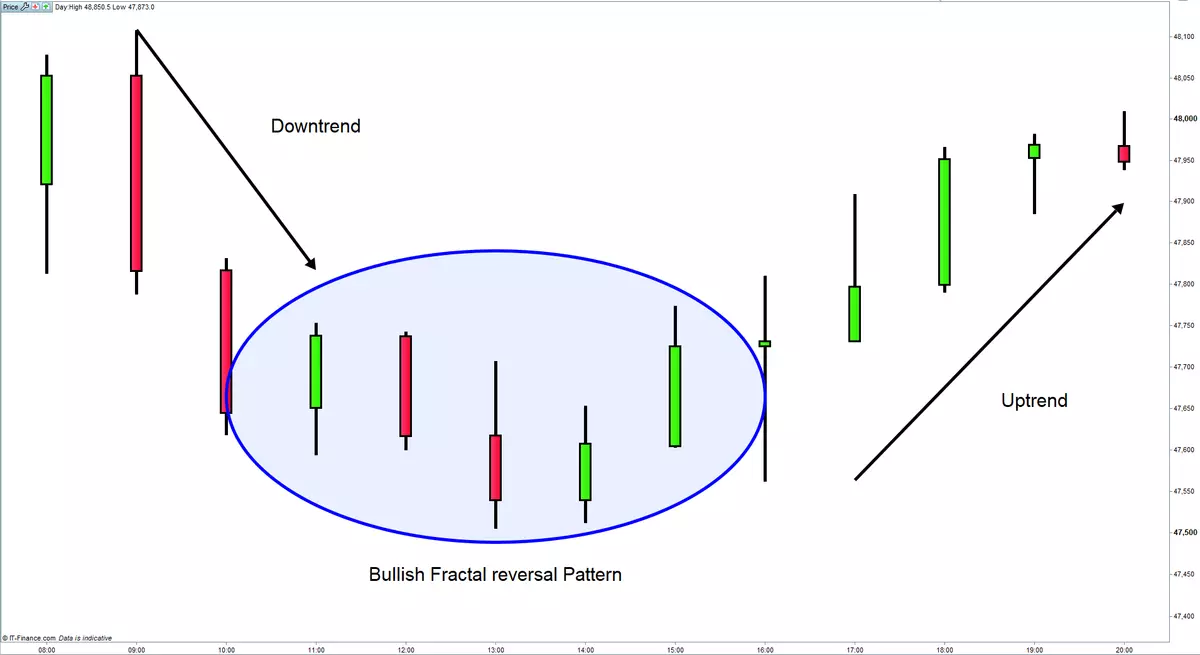

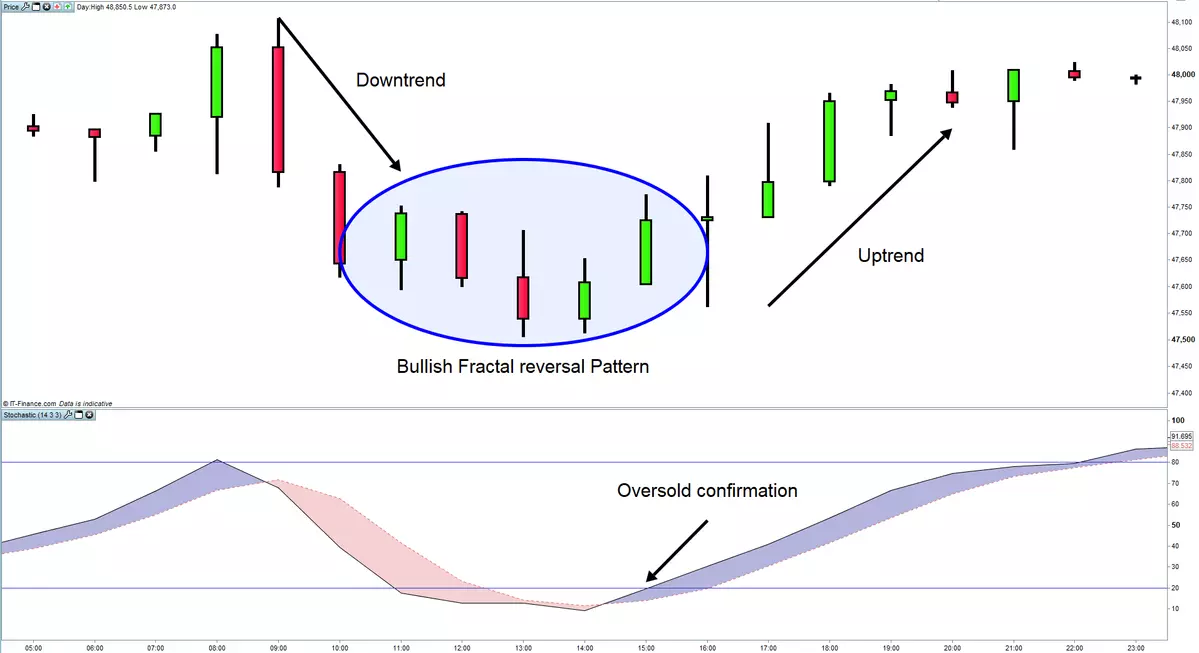

A bullish fractal reversal pattern suggests the end of near-term downtrend and beginning of a new uptrend. Traders might use this pattern as a long entry signal or a signal to exit an existing short position.

Many traders will use fractal signals in conjunction with oscillators such as the stochastic or relative strength index (RSI) for a confirmation of a bullish buy signal. In this regard a fractal buy signal would be considered to have greater validity when accompanied by an oversold signal.

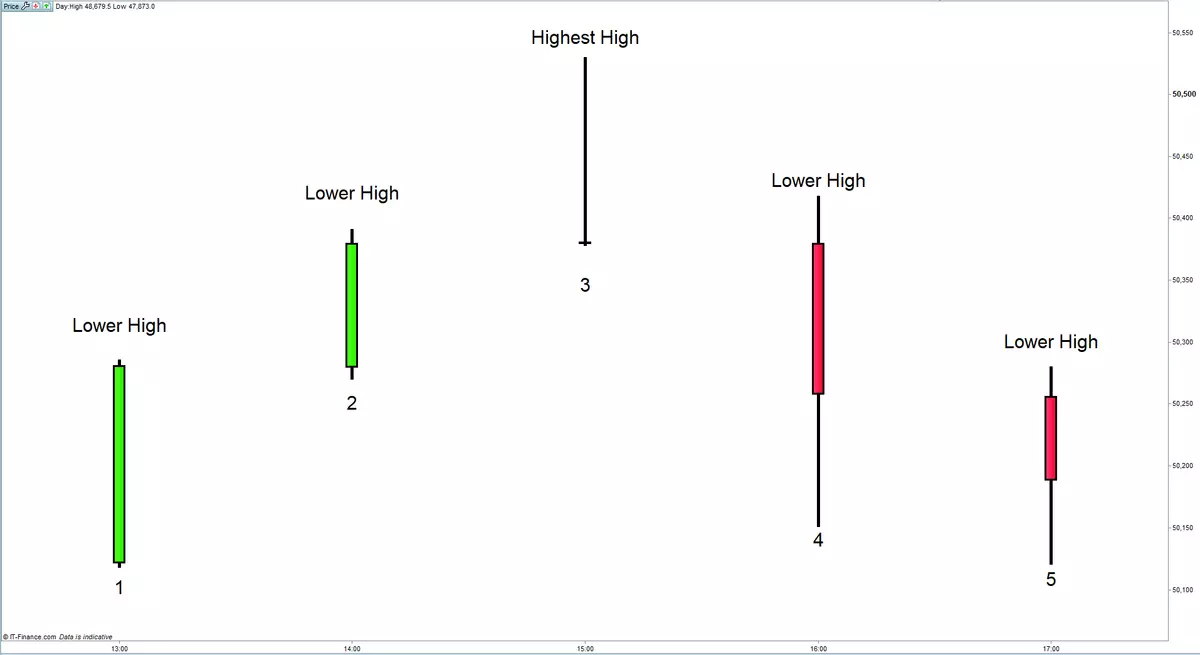

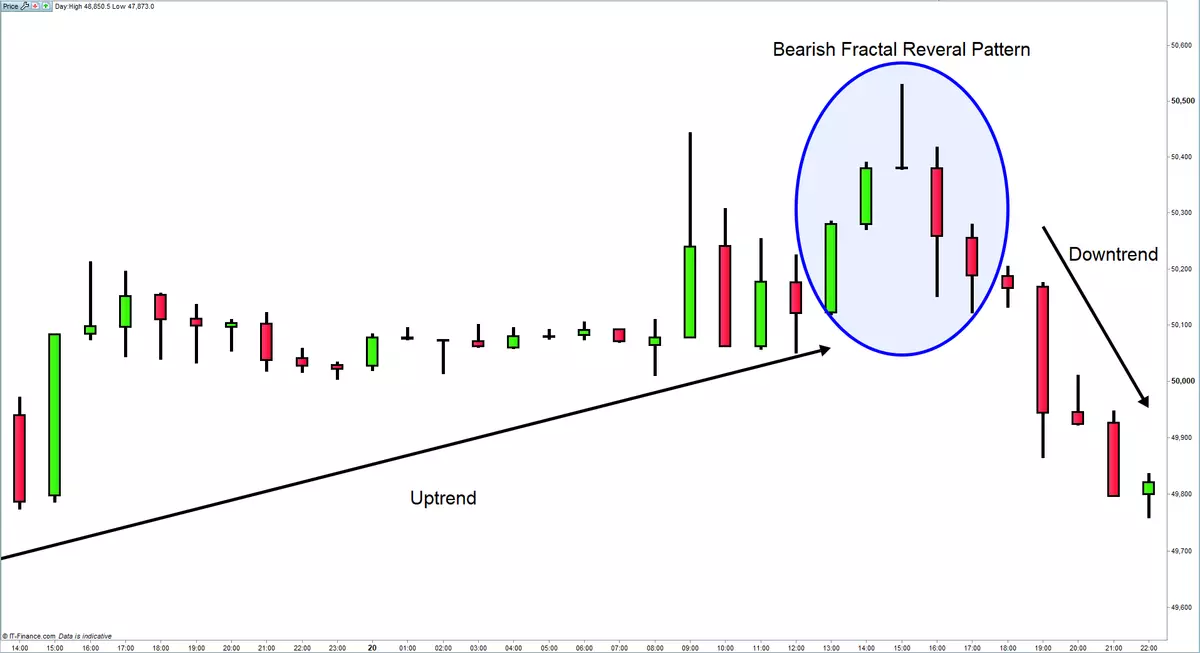

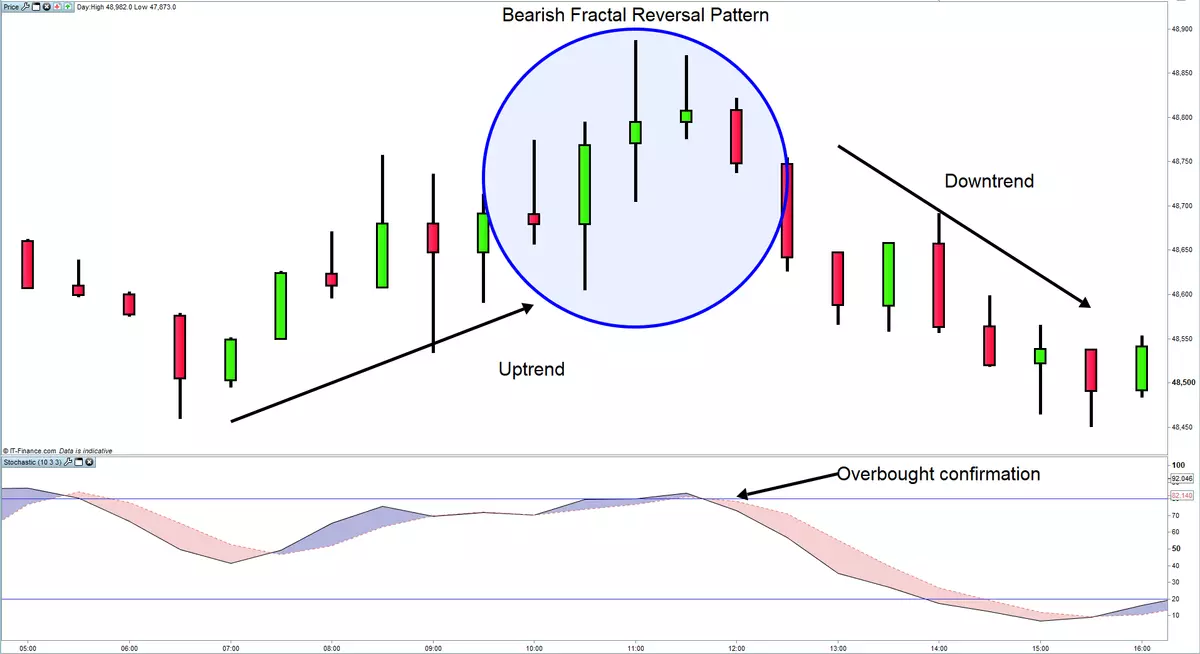

For a bearish fractal reversal pattern:

- The third candle in a series of five would be marked as having the highest high

- The first two candles in the pattern would have lower highs than the middle candle

- The last two candles in the pattern would have lower highs than the middle candle

The following graph illustrates a bullish fractal pattern.

A bearish fractal reversal pattern suggests the end of near-term uptrend and the beginning of a new downtrend. Traders might use this pattern as a short entry signal or a signal to exit an existing long position.

Traders will often use fractal signals in conjunction with oscillators such as the stochastic or RSI for a confirmation of a bearish sell signal. In this regard a fractal sell signal would be considered to have greater validity when accompanied by an overbought signal.

Fractals: multiple time frame analysis

Another unrelated interpretation of fractal analysis in trading, is that of multiple time frame analysis. In this regard traders might use fractionalised times frames in their analysis to draw forecasting views and trading ideas.

For example, a trader might use a daily or weekly chart time frame to get a bigger picture view of the market he wishes to trade. Thereafter the trader may look to a smaller time frame such as a 1-hour or 15-minute chart time frame to help fine tune entry and exit points.

A simple fractal trading strategy could look something like this:

- Identify major trend direction on a daily chart

- Use a 1-hour chart to identify entry and exit points into the market

- Entry signals on the 1-hour time frame must only be considered if they align with the trend deduced from the daily chart

- Signals against the trend identified on the daily time frame are not signals to trade against the trend but rather a suggestion to exit existing positions

How to trade with fractals indicator

There are two common trading concepts in technical analysis relating to fractal trading; fractal reversal patterns and fractal multiple time frame analysis.

Fractal reversal patterns

- A bullish fractal implies that a downtrend has reached an end and that a new uptrend may be ensuing

- A bullish fractal signal is considered a short exit signal or long entry signal

- These patterns are made up of five bars or candlesticks

- The middle candle in the pattern has a lower low than the candles which precede and succeed it

- The first two candles in the pattern have higher lows than the middle candle

- The last two candles in the pattern also have higher lows than the middle candle

- Oversold signals are often used to validate a bullish fractal pattern

- A bearish fractal implies that a uptrend has reached an end and that a new downtrend may be ensuing

- A bearish fractal signal is considered a long exit signal or a short entry signal

- These patterns are made up of five bars or candlesticks

- The middle candle in the pattern has a higher high than the candles which precede and succeed it

- The first two candles in the pattern have lower highs than the middle candle

- The last two candles in the pattern also have lower highs than the middle candle

- Overbought signals are often used to validate a bullish fractal pattern

Fractal: multiple time frame analysis

- Fractals can assume the use of multiple time frames in trading a security

- Traders may look at a larger chart time frame to arrive at a bigger picture awareness of the security in question ie a gauge of longer-term trend

- Traders may then look to a smaller chart time frame to arrive at entry and exit triggers into that market

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.