Where next for USD as BTC surges past $45,000

Key points

- Bitcoin has risen 200% since last January - hitting $45,000 a coin last week

- Historically, BTC and USD are negatively correlated

- This month, the correlation has flipped to +0.1

What happens to USD when Bitcoin rises?

The dynamic between the US dollar and Bitcoin (BTC) has been a topic of much intrigue in the financial world. Over the past year, Bitcoin has seen a significant rally, surpassing the $45,000 mark—a level not seen since mid-2022. This surge has come amid a period where the US dollar has also experienced its own upside, prompting investors to question the traditional inverse correlation between the two assets.

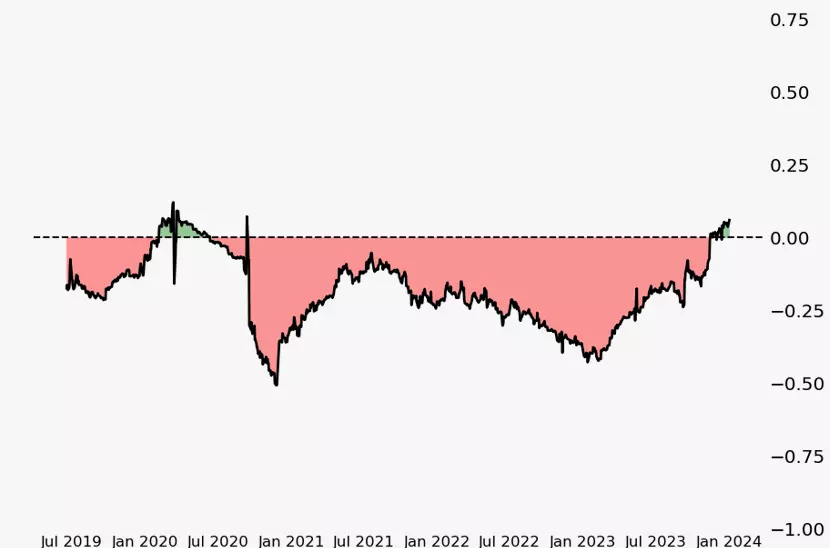

Historically, the US dollar and Bitcoin have exhibited an inverse relationship. When Bitcoin's value has risen, the US dollar has tended to weaken, and vice versa. This trend was particularly noticeable in 2020 and throughout 2021 when Bitcoin experienced a bull run while the US dollar approached its lows. However, the landscape shifted in 2022, with Bitcoin facing a downturn and the US dollar reaching historic highs.

Despite these trends, the correlation between Bitcoin and the US dollar has not always been straightforward. The correlation coefficients have hovered between negative 0.1 and 0.5, suggesting a significant but not overwhelmingly direct inverse relationship. Recent weeks have seen a notable shift, with the correlation turning positive for the first time in years, leading to speculation about a changing dynamic between the two.

Bitcoin - US dollar correlation

Bitcoin is commonly denominated in US dollars (USD), US dollar coin (USDC), or Tether (USDT), all of which are linked to the value of the USD. As Bitcoin's price increases, it doesn't necessarily mean that the USD must decrease. In theory, Bitcoin could rise while the USD remains stable or even appreciates against other major currencies like the euro, Japanese yen, or British pound.

The relationship between Bitcoin and the USD can be compared to that of crude oil, which is also priced in USD. Despite the assumption that a rising crude oil price indicates a weakening dollar, there have been instances where both crude oil prices and the USD have appreciated simultaneously. Similarly, both markets have experienced downturns together, illustrating that an asset priced in USD does not always move inversely to the currency.

Investors looking to navigate the markets in 2024 could consider diversifying their exposure by pairing Bitcoin with different currencies or speculate using assumptions on US dollar. If one is bullish on both Bitcoin and the USD, they could buy Bitcoin against the USD and simultaneously take a position that is long on USD against another currency like the euro. Conversely, if one is bullish on Bitcoin but bearish on the USD, they could consider selling the USD against another currency while holding Bitcoin.

As traders explore the evolving landscape of cryptocurrency and forex markets, it is important to remember the inherent volatility associated with these investments. Bitcoin is known for its high annual volatility in recent years while the USD is typically more subdued. This volatility presents both opportunities and risks, and investors must carefully consider their strategies and risk tolerance.

The interplay between the US dollar and Bitcoin remains a complex and evolving narrative. As we proceed through 2024, traders should stay informed, adapt to changing correlations, and consider a range of strategies to optimize their positions in these dynamic markets. Whether seeking higher volatility or a more stable investment, the key is to understand the underlying factors driving each asset and to manage exposure accordingly.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.