Will the Fed Hike Interest Rates?

What are the probabilities of a rate hike?

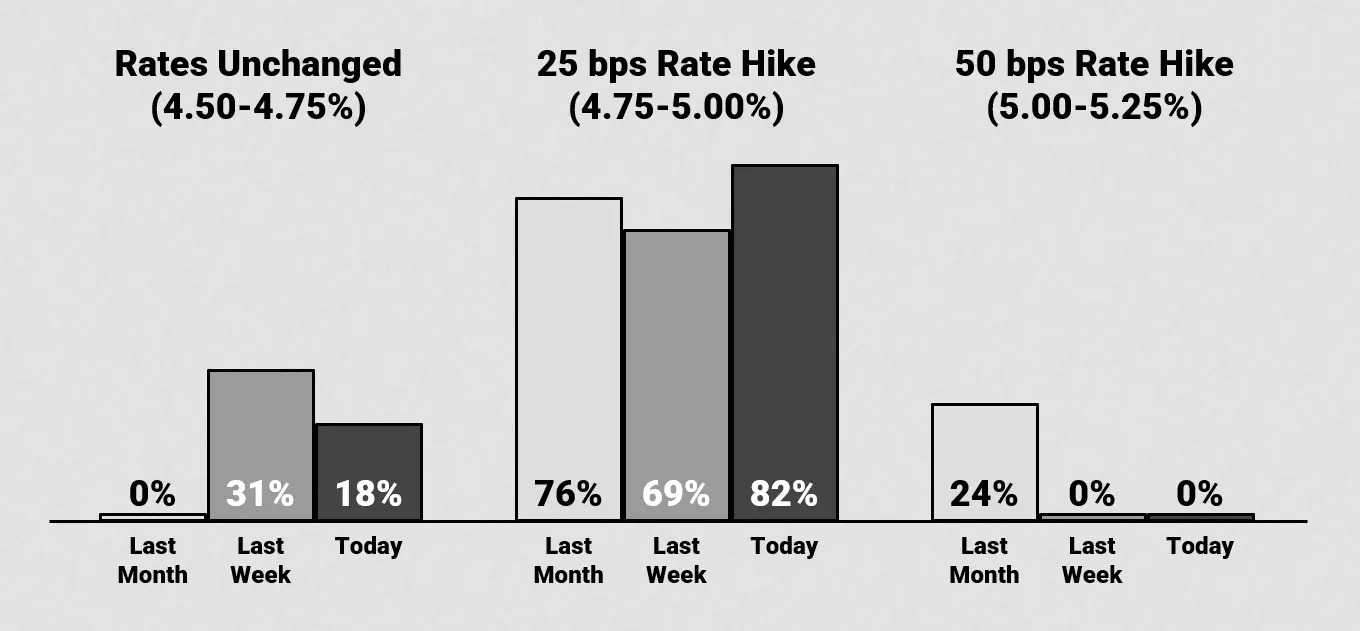

The probabilities around the FOMC’s rate decision are approximately 80-20 in favor of a 25-bps (0.25%) interest rate hike versus holding rates unchanged as of the day before the meeting – the decision occurs at 2pm ET on March 22nd.

While a 25-bps hike has been the most likely outcome for the last month, the outside chance has shifted from a larger hike – 50 bps – to none at all. This shift is emblematic of the shift in sentiment from fear of inflation risk to fear of a banking sector collapse.

Should the Fed fight inflation or recession?

Interest rates were raised steadily over the last year as inflation rose – higher rates are used to slow down the flow of money and thus inflation. The changing interest rate environment, however, caught some financial companies off guard, and fear has reentered the stock market – lower rates are used to ease economic tension.

This “inflation vs recession” situation finds the Fed in a relatively awkward conundrum: should they hike to fight inflation or cut to fight economic recession? The current US yield curve inversion – short-term interest rates higher than long-term rates – projects that the Fed might continue to hike in the short term and potentially cut interest rates in the medium to long term.

How will the FOMC Meeting affect forex?

From last March to present, the Fed hiked interest rates from 0% to 4.5%; in the same time, US dollars appreciated against most major currencies in the forex pair market. Given this trend, if the Fed continues to raise interest rates, then USD could appreciate further; on the other hand, if stock market fear causes rates to be lowered, US dollars could fall in value.

How to trade US dollar

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on USD pairs

Trading forex requires an account with a forex provider like tastyfx. Many traders also watch major forex pairs like EUR/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.